Associated Studying

USDT flexes its muscle tissue

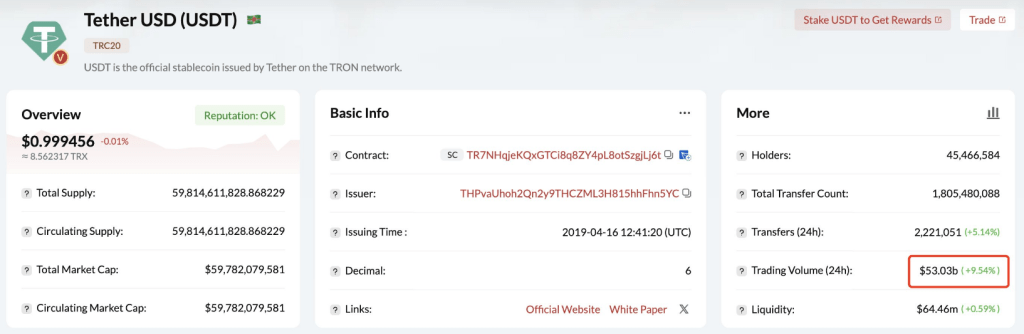

USDT’s dominance is clear. Since its founding in 2014, it’s obtainable on a number of blockchains and its market cap has exploded. Lookonchain information reveals that the single-day transaction quantity of USDT transactions on Tron reached a staggering US$53 billion, exceeding Visa’s every day common transaction quantity of US$42 billion. This 20% lead highlights the growing adoption of stablecoins in every day transactions.

24 hour buying and selling quantity USDT exist #wavefieldnetwork At $53B, it exceeds Visa’s common every day transaction quantity.

Visa’s buying and selling quantity within the first quarter of 2024 was $3.78T, with a mean every day buying and selling quantity of $42B. pic.twitter.com/jolGKIUCxE

— Lookonchain (@lookonchain) June 21, 2024

Why did stablecoins rise?

So, what’s driving this surge? Not like conventional cryptocurrencies, that are recognized for wild value swings, stablecoins provide a secure haven. They’re sometimes pegged to fiat currencies such because the U.S. greenback, that means their worth stays comparatively secure. This stability makes them supreme for every day transactions, eliminating the considerations of sudden value drops that plague conventional cryptocurrencies. Moreover, stablecoins harness the ability of blockchain know-how to allow quicker, cheaper, and extra clear transactions in comparison with conventional programs.

upcoming rules

As stablecoins develop in reputation, governments are scrambling to determine regulatory frameworks. The Lummis-Gillibrand Funds Stablecoin Act in the US and comparable initiatives in the UK spotlight the worldwide concentrate on guaranteeing consumer safety and monetary stability within the face of this innovation. Whereas these rules are vital to accountable development, navigating the altering political local weather provides a further layer of complexity. For instance, as the overall election approaches, the UK’s cryptocurrency coverage stays unsure.

Associated Studying

The way forward for finance

Regardless of the challenges, the momentum behind stablecoins appears unstoppable. Their means to bridge the hole between conventional finance and the crypto world gives an simple benefit. Whereas every day transaction volumes could fluctuate and points comparable to rising Tron transaction charges must be addressed, the general pattern is evident.

Stablecoins are right here to remain, and their impression on the worldwide monetary system might be profound. As rules take form and the know-how matures, stablecoins have the potential to revolutionize the way in which we conduct every day transactions, ushering in a brand new period of economic inclusion and effectivity.

Featured photos from Pexels, charts from TradingView