One quantitative analyst famous how traits in BitMEX change reserves have affected Ethereum costs over the previous few years.

BitMEX Ethereum whales have displayed sensible forex habits in recent times

In a CryptoQuant Quicktake put up, an analyst mentioned the sample of ETH buying and selling reserves on the BitMEX platform. “Alternate reserves” right here refers to an on-chain metric that tracks the full quantity of Ethereum in any given centralized change pockets.

When the worth of this indicator rises, buyers will instantly make internet deposits to the platform. Since one of many predominant the reason why buyers transfer to exchanges is for promoting functions, this pattern may have a possible bearish affect on asset costs.

Then again, the decline on this indicator signifies that the web quantity of cryptocurrency provide is shifting away from wallets related to exchanges. Traders usually place their tokens in self-custody once they plan to carry on to them for the long run, so this pattern might be constructive for the coin.

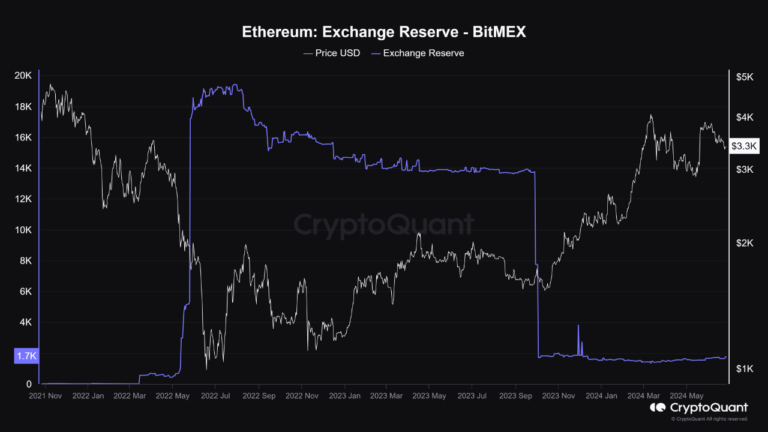

Now, the chart beneath reveals the pattern of BitMEX’s Ethereum change reserves over the previous few years:

As may be seen from the chart above, Ethereum change reserves on the BitMEX platform elevated dramatically in mid-2022. This means that buyers have made massive internet deposits to the change.

In keeping with the quant, the platform has numerous whales, so this huge influx exercise will replicate the habits of those huge buyers.

Curiously, the speedy progress on this indicator occurred earlier than ETH dropped in the direction of its bear market lows. So these massive shareholders appear to have anticipated issues to worsen for the asset, in order that they began promoting whereas they nonetheless had the prospect.

One other notable change in BitMEX change reserves occurred in September 2023, when whales took out massive quantities of Ethereum, nearly fully giving again the good points from the earlier bear market.

As is obvious from the chart, shortly after these internet outflows occurred, the cryptocurrency’s value started to rise considerably, finally heading above the $4,000 stage for the primary time since December 2021.

It appears like these sensible cash whales’ instincts concerning the market have been proper as soon as once more, as they have been in a position to purchase in on the rally.

The indicator has not seen any main modifications as its worth has been buying and selling sideways since internet outflows occurred in September. Given the historic traits, any sudden new deviations are price being cautious of as they may result in one other shift for Ethereum.

Ethereum value

Ethereum began recovering from the lows yesterday, however the good points have calmed down as ETH continues to be buying and selling round $3,400 at present.