Cryptocurrency change BitMEX co-founder Arthur Hayes not too long ago offered a complete evaluation in his newest article “Zoom Out,” drawing compelling parallels between the financial turmoil of the Thirties to Seventies and right this moment’s monetary panorama. , with a particular deal with its impression on Bitcoin and the cryptocurrency bull market. His in-depth analysis reveals that historic financial patterns, if correctly understood, can present a blueprint for understanding a possible restoration from the Bitcoin and cryptocurrency bull market.

Perceive the monetary cycle

Hayes begins by exploring the key financial cycles that started with the Nice Despair, by way of the financial growth of the mid-Twentieth century, after which into the stagnant Seventies. He divides these shifts into what he calls “native” and “world” cycles, that are essential to understanding broader macroeconomic forces.

Native cycles are characterised by intense state consideration and the prevalence of financial protectionism and monetary repression. These cycles typically end result from authorities responses to extreme financial crises, prioritizing nationwide restoration over world cooperation, typically resulting in inflation resulting from devaluation of fiat currencies and elevated authorities spending.

Associated Studying

In distinction, world cycles are characterised by intervals of financial liberalization that encourage world commerce and funding however typically result in deflationary pressures resulting from elevated competitors and effectivity in world markets.

Hayes took a better take a look at the impression of every cycle on the asset class, noting that in native cycles, non-fiat belongings corresponding to gold have traditionally carried out properly resulting from their nature as a hedge towards inflation and forex debasement.

Hayes straight in contrast the beginning of Bitcoin in 2009 to the financial local weather of the Thirties. Simply because the financial crises of the early Twentieth century led to modifications in financial coverage, the monetary disaster of 2008 and subsequent quantitative easing laid the inspiration for the introduction of Bitcoin.

Why the Bitcoin bull run will resume

Hayes believes that Bitcoin’s emergence comes throughout what he sees as a brand new native cycle, characterised by a world recession and important central financial institution intervention, which displays previous pressures on the standard monetary system and the rise of different belongings corresponding to gold. interval.

Increasing on the analogy between gold within the Thirties and Bitcoin right this moment, Hayes clarified how gold can act as a secure haven throughout occasions of financial uncertainty and rampant inflation. He believes that Bitcoin’s decentralized and state-independent nature is properly suited to attain comparable functions in right this moment’s turbulent financial setting.

Associated Studying

Hayes identified: “Bitcoin operates exterior of conventional state techniques, and its worth proposition turns into significantly evident in occasions of inflation and monetary repression.” He believes that this attribute of Bitcoin makes it a really perfect selection for individuals who are fighting forex debasement and monetary repression. An indispensable asset for these in search of to protect wealth in unsure circumstances.

Hayes famous that the U.S. funds deficit has soared and is predicted to achieve $1.915 trillion in fiscal 2024, a contemporary indicator that parallels fiscal expansions in previous native cycles. The deficit is considerably larger than in earlier years and is the very best exterior the COVID-19 period resulting from elevated authorities spending much like historic intervals of presidency stimulus to stimulate the financial system.

Hayes makes use of these fiscal indicators to indicate that simply as previous native cycles led to rising non-state asset valuations, present fiscal and financial insurance policies are prone to improve Bitcoin’s attraction and worth.

“Why am I assured that Bitcoin will regain its magic? Why am I assured that we’re within the midst of a brand new large-scale native, nation-state-first inflation cycle?” Hayes asks rhetorically in his article. He believes that previously financial The dynamics that drove the worth of belongings like gold throughout the turmoil are actually adjusting to help the worth of Bitcoin.

He concluded: “I feel fiscal and financial situations are free and can proceed to be free, so holding cryptocurrencies is one of the simplest ways to protect wealth. I consider right this moment will rhyme with the Thirties to the Seventies, which suggests, provided that I nonetheless Being free to change from fiat to cryptocurrencies, I ought to accomplish that as a result of devaluation is coming as a result of growth and centralization of credit score allocation within the banking system.

At press time, BTC was buying and selling at $62,649.

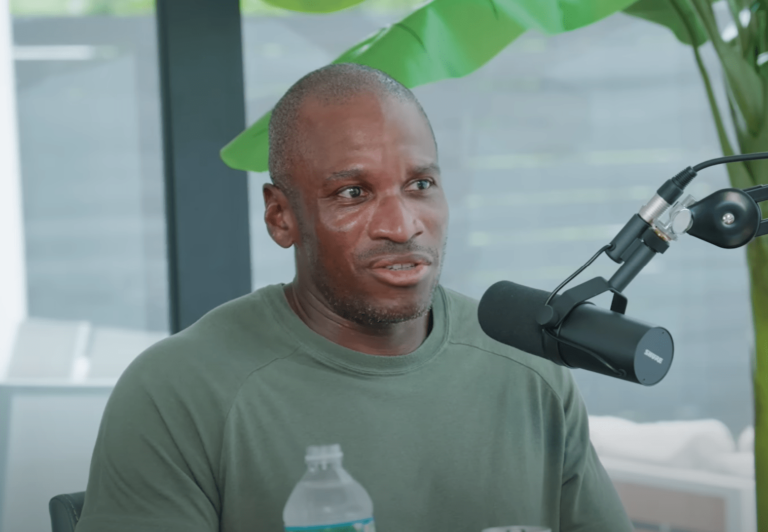

Featured picture from YouTube / What Bitcoin Did, chart from TradingView.com