On-chain analytics agency Santiment has revealed which altcoins are presently in historic shopping for zones based mostly on a good worth mannequin.

Numerous altcoins are presently approaching the chance zone

In a brand new article on X, Santiment discusses the present state of affairs of assorted property within the cryptocurrency area based mostly in the marketplace worth to realized worth (MVRV) ratio. The MVRV ratio is a metric that tracks the revenue and loss standing of an handle on any given community.

When the worth of this indicator is larger than 1, it implies that buyers presently maintain internet earnings. Alternatively, indicators under this threshold imply that losses dominate the market.

After all, an MVRV ratio of precisely 1 implies that unrealized losses on the community precisely equal unrealized earnings, so the common holder will be thought-about to be simply breaking even.

Traditionally, when investor earnings surge, a correction is extra possible. The higher the earnings progress of holders, the extra inclined they’re to promote. Likewise, having holders underwater additionally contributes to the formation of a backside, as sellers grow to be exhausted on this state of affairs.

Primarily based on these info, Santiment developed an Alternative and Hazard Zone mannequin that makes use of variations in MVRV ratios over completely different time frames to raised estimate whether or not an asset presently provides a purchase or promote window.

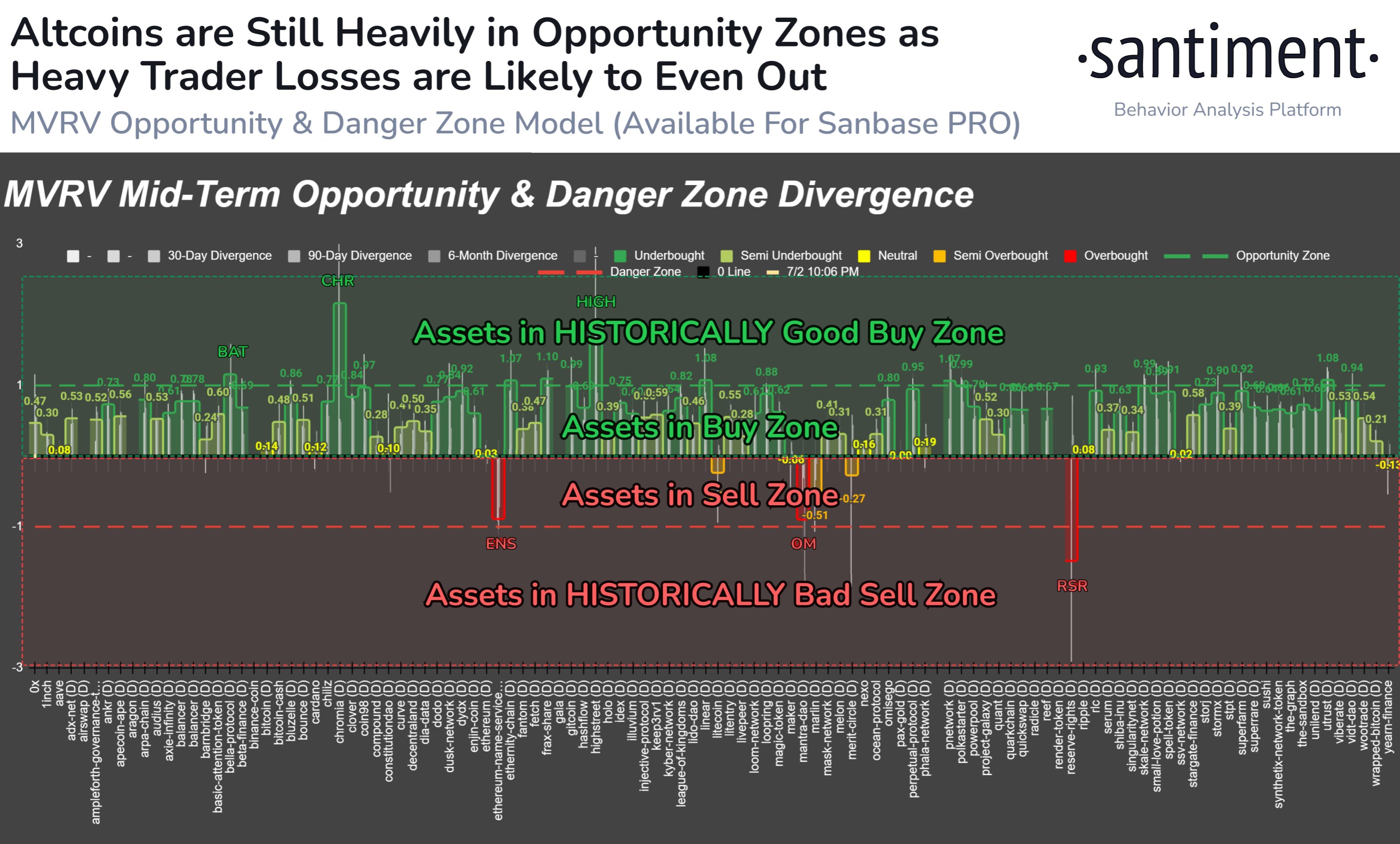

Now, right here’s a chart shared by the analyst agency displaying how completely different altcoins fare in response to this mannequin:

Be aware that on this mannequin, the zero mark acts because the impartial 1 degree of the MVRV ratio. Moreover, the polarity is flipped right here, with values under zero that means earnings dominate and above zero that means losses.

The chart exhibits that almost all altcoins are presently in optimistic territory, indicating that their buyers are struggling. Amongst them, Fundamental Consideration Token (BAT), Chromia (CHR) and Highstreet (HIGH) are significantly eye-catching as their MVRV variations exceed 1.

Beneath this mannequin, areas above 1 are known as “alternative zones” as a result of traditionally property have supplied probably the most worthwhile alternatives inside this zone.

Whereas most altcoins are presently at the very least barely undervalued, there are a number of, like Ethereum Title Service (ENS), MANTRA (OM), and Reserve Rights (RSR), which might be at or close to the hazard zone. The hazard zone happens under -1 and corresponds to the chance zone, the place the coin is overvalued.

Ethereum worth

Ethereum, the most important altcoin, plunged greater than 4% prior to now 24 hours, taking the value under $3,300.