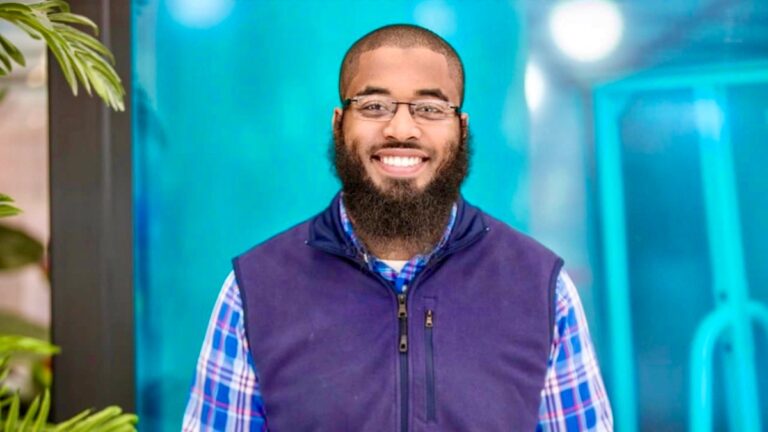

Sidney Scott has determined to stop the enterprise capital rat race and is now jokingly auctioning off his vests – with bids beginning at $500,000.

The Driving Forces sole common companion introduced on LinkedIn this week that he was closing the $5 million fintech and deep tech enterprise capital fund he based in 2020, calling the previous 4 years “a wild experience.”

The wholesome efficiency of his first small-cap fund wasn’t sufficient. He advised TechCrunch that as competitors grows for what are nonetheless basically a handful of laborious tech and deep tech offers, he realizes it is going to be a problem for smaller funds like his.

“It will not be straightforward, nevertheless it’s the fitting selection for the present market,” he stated.

Scott additionally thanked those that have supported him, together with entrepreneur Julian Shapiro, neuroscientist Milad Alucozai, Intel Capital’s Aravind Bharadwaj, 500 International’s Iris Solar and UpdateAI CEO Josh Schachter.

Throughout this time, he additionally participated in constructing the primary synthetic intelligence and deep expertise investor community with Handwave, working with buyers from Nvidia, M12, Microsoft Ventures, Intel Capital, and First Spherical Capital, amongst others.

The funding consists of about 20 investments in firms equivalent to SpaceX, Rain AI, xAI and Atomic Semi. Scott advised TechCrunch that your entire portfolio has a internet inner price of return, which is a measure of the annual progress price an funding or fund generates, of greater than 30%. An IRR efficiency of 30% for a seed fund like that is thought of stable and exceeds the deep tech business common IRR (about 26%), in line with Boston Consulting Group.

5 years in the past, when Scott wrote his thesis for the fund, it was a special world. On the time, he stated, most buyers shunned laborious and deep tech in favor of software-as-a-service and fintech.

That is for varied causes. Enterprise capital can have a go-with-the-flow mentality, whereas SaaS was thought of extra of a money-making wager on the time. However enterprise capital additionally eschews deep tech as a result of buyers consider—maybe appropriately—that it requires giant quantities of capital, longer improvement cycles, and experience. Deep tech typically includes new {hardware}, however all the time includes constructing expertise merchandise round scientific advances.

“It is surprising that the identical causes are why many firms at the moment are immediately investing in deep expertise, which may be very ironic, however it’s domain-related,” Scott stated. “Everyone seems to be investing in speedy scaling, speedy launch and go to market. They may put money into these extraordinarily good individuals who will sooner or later flip the science undertaking into an working enterprise.

He’s now looking for fintech buyers who rejected his deal a 12 months in the past and at the moment are elevating tons of of hundreds of thousands of {dollars} in funds particularly targeted on deep tech.

Whereas he didn’t identify names, some deep tech-focused enterprise capital companies embrace Alumni Ventures, which closed its fourth deep tech-dedicated fund in 2023; Lux Capital, which raised a $1.15 billion deep tech fund in 2023 Playground International, which raised greater than $400 million for deep tech in 2023; Two Sigma Ventures, which raised $400 million for deep tech in 2022 (SEC information present it raised one other $500 million in 2024).

In the present day, deep tech accounts for about 20% of all enterprise capital funding, in contrast with about 10% a decade in the past. Significantly prior to now 5 years, it “has turn out to be a mainstream vacation spot for company, enterprise capital, sovereign wealth and personal fairness funds,” in line with a current report from Boston Consulting Group.

Scott additionally believes that many newcomers to the sphere are getting ready for “eye-opening in three years” and that the growth in deep expertise funding is simply too quick.

The everyday enterprise capital inflation cycle begins when cash pours right into a restricted variety of offers, with VCs bidding up the worth they’re keen to pay for fairness, driving up valuations and making the area reasonably priced for everybody. Dearer – prohibitive for an unbiased fund like this.

Whereas large-scale exits from startups have been restricted by a closed IPO market and fading curiosity in SPACs, deep tech has nonetheless discovered success in areas equivalent to robotics or quantum computing.

He stated he isn’t bearish on enterprise capital or laborious tech firms on the whole, however does anticipate a “bullwhip impact” on deep tech investing, with early buyers and VCs scrambling to repeat earlier breakthroughs or appeal to consideration. Notable outcomes.

As is the way in which with enterprise capital, he predicts that extra capital will appeal to extra buyers, together with these with much less experience, which he says will result in a proliferation of deep tech startups. Nevertheless, this may create unrealistic expectations and intense efficiency strain for brand spanking new startups, he stated. Since enterprise capital typically goes by way of cycles, he believes investor sentiment may shortly flip unfavourable if market situations change.

“Given the extraordinarily small variety of consultants and builders, mixed with the capital-intensive nature of laborious tech, the valuation inflation section is prone to speed up, shortly driving up startup valuations,” Scott stated. “This can influence complete ecosystem, resulting in funding difficulties, slower improvement and doable closures, which may additional erode investor confidence and create a unfavourable suggestions loop.”