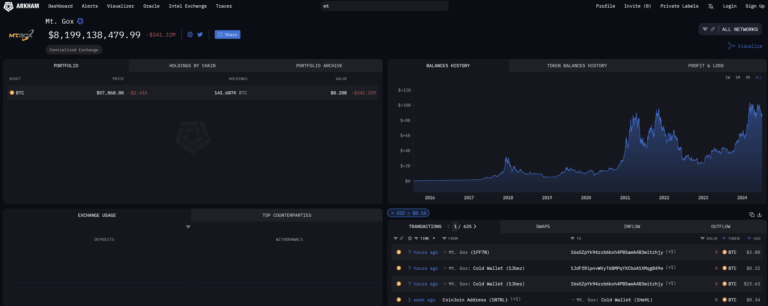

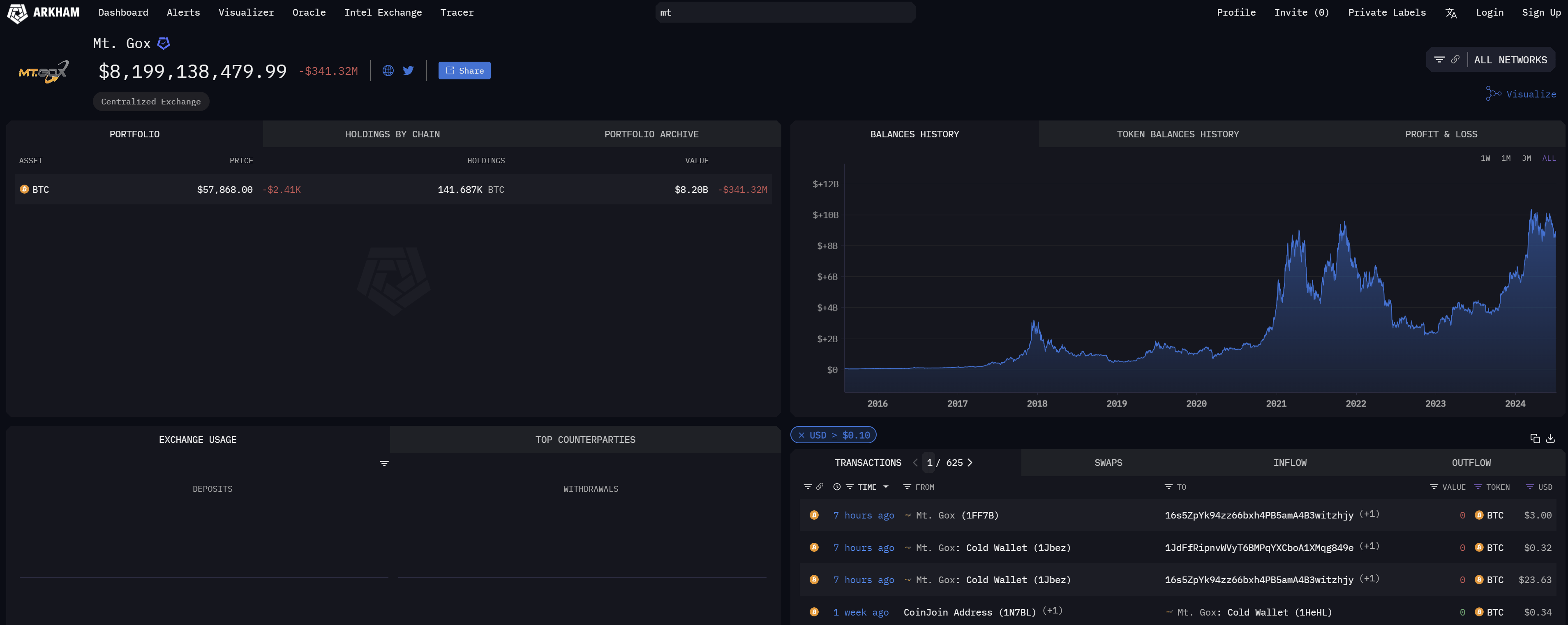

Based on knowledge from Arkham Intel, Mt. Gox has initiated the method of repaying collectors by transferring a nominal quantity of Bitcoin to one of many designated exchanges. The event comes after months of hypothesis and planning over the fee of some $8.2 billion in Bitcoin owed to collectors of the failed trade.

Mt. Gox Bitcoin repayments began?

Earlier right now, three transactions have been executed by three wallets traditionally related to Mt. Gox. Probably the most vital of those concerned transferring $24 in Bitcoin to a pockets, which then despatched the funds to Bitbank’s scorching pockets. Bitbank, together with Kraken, Bitstamp, SBI VC Commerce and Bitgo, is listed as one of many exchanges approved to facilitate repayments and can make these funds accessible to clients inside as much as 90 days of receipt.

Associated Studying

Nonetheless, there may be some uncertainty surrounding these transactions, because the funds usually are not transferred straight from Mt. Gox’s major pockets. Observers have speculated whether or not the exercise might be a preliminary take a look at earlier than collectors are repaid on an enormous switch. Mt. Gox Rehabilitation Trustees beforehand stated the reimbursement course of was scheduled to start in early July, however the actual switch date has not been made public.

The opposite two transactions have been a switch of BTC price $3.00 and one other switch of BTC price $0.32 to a brand new pockets.

This refined funding transfer comes throughout a tumultuous time for Bitcoin, which has seen its worth plummet greater than 20% since reaching $72,000 and is at present hovering round $57,700.

what to anticipate

Peter Chung, head of analysis at Presto Analysis, lately offered perception into the broader implications of Mt. Gox’s reimbursement. He outlined the anticipated dynamics between Bitcoin (BTC) and Bitcoin Money (BCH) and predicted vital buying and selling alternatives.

“Mt. Gox’s restoration trustee plans to distribute billions of {dollars} price of BTC and BCH to Mt. Gox collectors between July 1 and October 31, 2024. This will likely change the availability and demand of BTC and BCH throughout this four-year interval. dynamic.

Associated Studying

Chung highlighted the totally different impacts on BTC and BCH: “Our evaluation reveals that the promoting strain on BCH will probably be 4 occasions that of BTC, which is 24% of BCH’s every day buying and selling quantity in comparison with 6% of BCH’s every day buying and selling quantity. Bitcoin . This distinction displays a special investor base, with BCH being considerably weaker and extra more likely to dump its holdings.

He advises merchants on potential methods: “Pairing an extended BTC perpetual contract with a brief BCH perpetual contract is the best market-neutral option to specific this view, until there may be funding rate of interest threat.” For these frightened about funding price fluctuations Individuals, Chung prompt exploring “different strategies resembling short-term futures or borrowing BCH on the spot market.”

At press time, BTC was buying and selling at $57,727.

Featured picture created with DALL·E, chart from TradingView.com