Bitcoin (BTC) fell sharply on Thursday, falling to $56,700. Bitcoin costs haven’t seen such ranges since Could 1 as Bitcoin faces a number of challenges, together with U.S. political uncertainty and an ongoing sell-off of BTC seized by the German authorities. These elements induced the value of Bitcoin to fall again almost 20%, inflicting buyers to fret.

Uncovering the explanation why Bitcoin costs are falling

In accordance with a current report from Bloomberg ReportBuyers are contemplating what would possibly occur if President Joe Biden decides to withdraw his U.S. re-election bid. One chance is the emergence of a stronger Democratic contender who might pose a problem to Republican Donald Trump, who has an agenda that favors the cryptocurrency trade.

Richard Galvin, co-founder of hedge fund Digital Asset Capital Administration, careworn that “stronger Democratic candidates” could not assist cryptocurrency As an element affecting Bitcoin’s short-term weak spot.

Associated Studying

Moreover, the pending collapse of the Mt. Gox Bitcoin trade, which deliberate to provoke refunds, affecting clients who suffered an alleged hack almost 10 years in the past, and the sell-off by the U.S. and German governments have additionally added to the present weak spot in Bitcoin . Bitcoin market.

Merchants are carefully monitoring the danger of decision of Bitcoin being seized by the U.S. and German governments. New knowledge from Arkham Intelligence reveals {that a} pockets linked to the German authorities moved roughly $75 million price of funds. Bitcoin A collection of comparable transfers have been added to the trade on Thursday.

In the meantime, managers of the collapsed Mt. Gox trade are regularly returning massive quantities of Bitcoin to collectors, leaving speculators unsure concerning the potential influence of the $8 billion deal in the marketplace.

Miner response and market influence

Alternatively, Bitcoin miners liable for the computing energy that helps the Bitcoin blockchain proceed to face monetary penalties Halving occasions, which cut back the variety of new tokens they obtain as rewards.

In response, some miners are promoting a part of their token inventories, including to promoting stress on Bitcoin. As Noel Acheson, corresponding writer of Cryptocurrency Now Macro, highlights, the continuing wrestle with miner promoting stress is affecting Bitcoin’s worth efficiency.

Nonetheless, Acheson famous that sentiment within the cryptocurrency market can change shortly, particularly if the market weakens US financial knowledge It triggered expectations for the Federal Reserve to implement unfastened financial coverage.

Moreover, potential approval for U.S. exchange-traded funds (ETFs) to put money into Ethereum might increase general market sentiment. Moreover, interpretations of U.S. political developments could change over time.

Matt Hougan, chief funding officer at Bitwise, stated potential adjustments on the high of the Democratic ticket might enhance the cryptocurrency’s place. He emphasised Washington’s angle digital belongings There have been constructive adjustments over the previous yr.

Glassnode predicts retest of earlier all-time highs

Regardless of Bitcoin’s poor worth efficiency and uncertainty, Jan Happel and Yan Allemann, founders of blockchain analytics platform Glassnode, preserve their Bitcoin targets, assertion BTC is predicted to succeed in the $110,000 space earlier than the market tops.

Notably, Alleman and Happel view the present consolidation as a retest of earlier all-time excessive territory. Nonetheless, to attain this, Bitcoin might want to break above the important thing ranges of $64,000 and subsequently $70,000, which would require additional market growth and worth motion.

Associated Studying

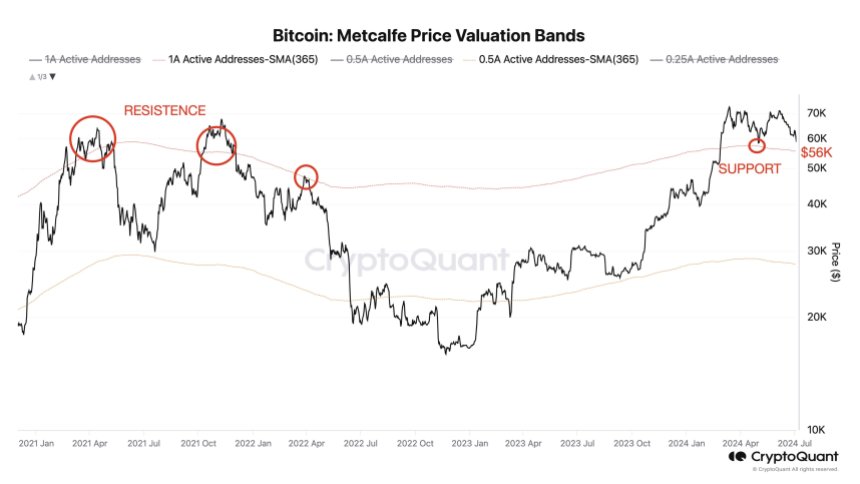

based on Julio Moreno stated the Metcalf worth valuation supplies insights into potential assist ranges for Bitcoin costs. Moreno stated that based mostly on this valuation, $56,000 needs to be a key assist stage for Bitcoin.

Moreno concluded that if Bitcoin worth fails to carry the important thing $56,000 stage, the correction might deepen, bringing extra extreme penalties for the market.

BTC has regained $57,300 ranges; nevertheless, the cryptocurrency has misplaced 5% up to now 24 hours, with no indicators of near-term bullish catalysts to climb above $60,000.

Featured pictures from DALL-E, charts from TradingView.com