Bitcoin is promoting off quickly. The world’s most precious coin fell greater than 5% in its last buying and selling day at spot charges and continued its downward spiral, simply topping $60,000. The psychological spherical has been at a noteworthy degree over the previous few days, particularly after the weekend’s positive aspects.

Bitcoin drops: Is it time to purchase?

Though Bitcoin is barely decrease and sellers are ruthless, one analyst believes now could be the perfect time to purchase. In an article by X, the analyst debate Bitcoin is on the cusp of the “spring” part of the Wyckoff Reaccumulation Mannequin.

The Wyckoff mannequin is a technical evaluation device utilized by merchants and chartists. Historically, it makes use of worth and quantity patterns to determine potential worth actions.

Associated Studying

Though Wyckoff describes a number of phases when it comes to worth patterns, most merchants all the time observe the “spring” part. When the value “rebounds” greater from this stage, the coin will typically get away of the present vary on the again of rising buying and selling quantity.

Trying on the every day Bitcoin chart, it’s clear that the value has been consolidating. Thus far, main help lies close to the Could and June 2024 lows. The worth then fell, falling beneath $57,000, and bottomed in Could round $56,500. Resistance lies between $72,000 and the March 2024 excessive.

Actually, Bitcoin is retesting main help ranges, surpassing $60,000 on July 4 and falling to $56,900 earlier immediately. In line with the Wyckoff mannequin, costs are priming for the spring part. This prediction is right here to remain, particularly if immediately’s losses usually are not confirmed.

Lengthy-term holders don’t promote, miners give up

Whereas analysts are optimistic, not everyone seems to be bullish. On-chain analyst Willy Woo stated the present sell-off is especially as a consequence of Pushed Give up by way of miners. Trying on the Bitcoin Hash Ribbon, the decline seems to have begun because the market weeds out “weak” miners.

For the reason that halving on April 20, the Bitcoin community has mechanically minimize BTC rewards in half to three.125 BTC. This transfer to automation places larger strain on miners to put money into gear and function it effectively. As income falls, solely probably the most environment friendly miners have an opportunity to revenue.

Associated Studying

Because of this, those that can’t improve their gear are pressured to exit the scene. If they do not, they haven’t any likelihood of persistently profitable block rewards. Previously eight months, on-chain information programme Miners have been promoting BTC, bucking the uptrend in Q1 2024 and exacerbating the correction since April.

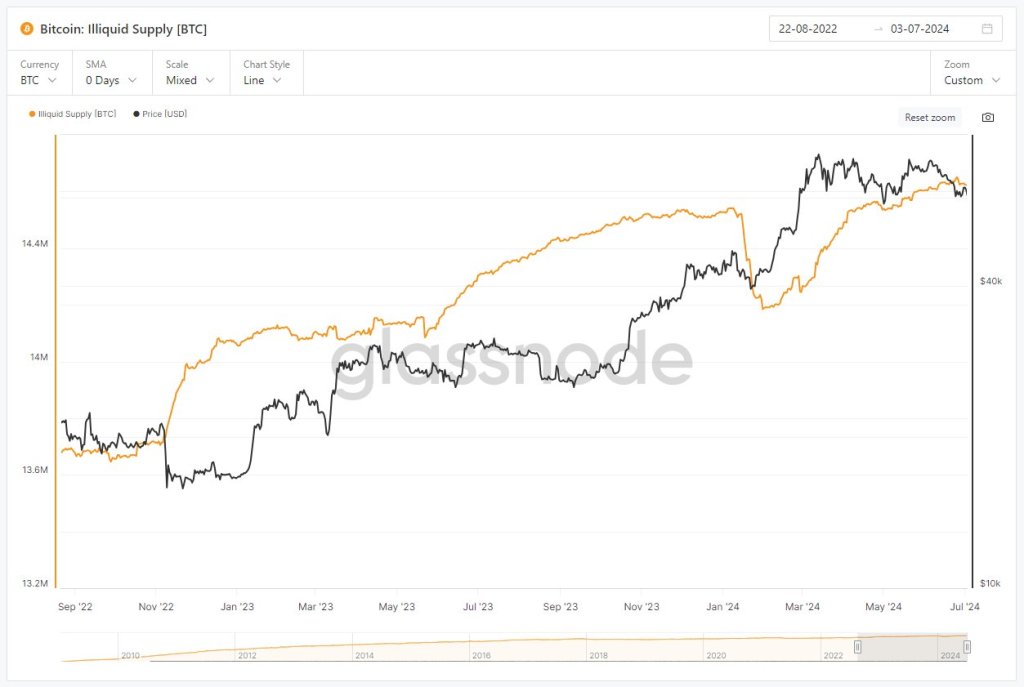

In opposition to this backdrop, long-term holders (primarily establishments and whales) stopped promoting in mid-January 2024. .

As proof, Bitcoin’s “illiquid provide,” which reveals the variety of Bitcoins that haven’t moved in additional than two years, is nearly at an all-time excessive.

Characteristic footage are from DALLE, charts are from TradingView