Knowledge reveals that the ratio of Bitcoin futures to identify buying and selling quantity has dropped by 63% for the reason that final bullish peak. That is what it means.

Bitcoin futures market shares decrease quantity on rally

As CryptoQuant founder and CEO Ki Younger Ju explains in a brand new article on X, the BTC market seems to be much less futures-driven than over the last bull run.

The metric of curiosity right here is the “Futures to Spot Quantity Ratio,” which, because the title suggests, tracks the ratio between Bitcoin futures and spot quantity.

Buying and selling quantity naturally refers to a measure of the whole quantity of cryptocurrencies traded on numerous exchanges collaborating within the trade.

When the ratio worth is larger, the amount within the futures market is larger than within the spot market. Likewise, low worth means spot buying and selling dominates the trade.

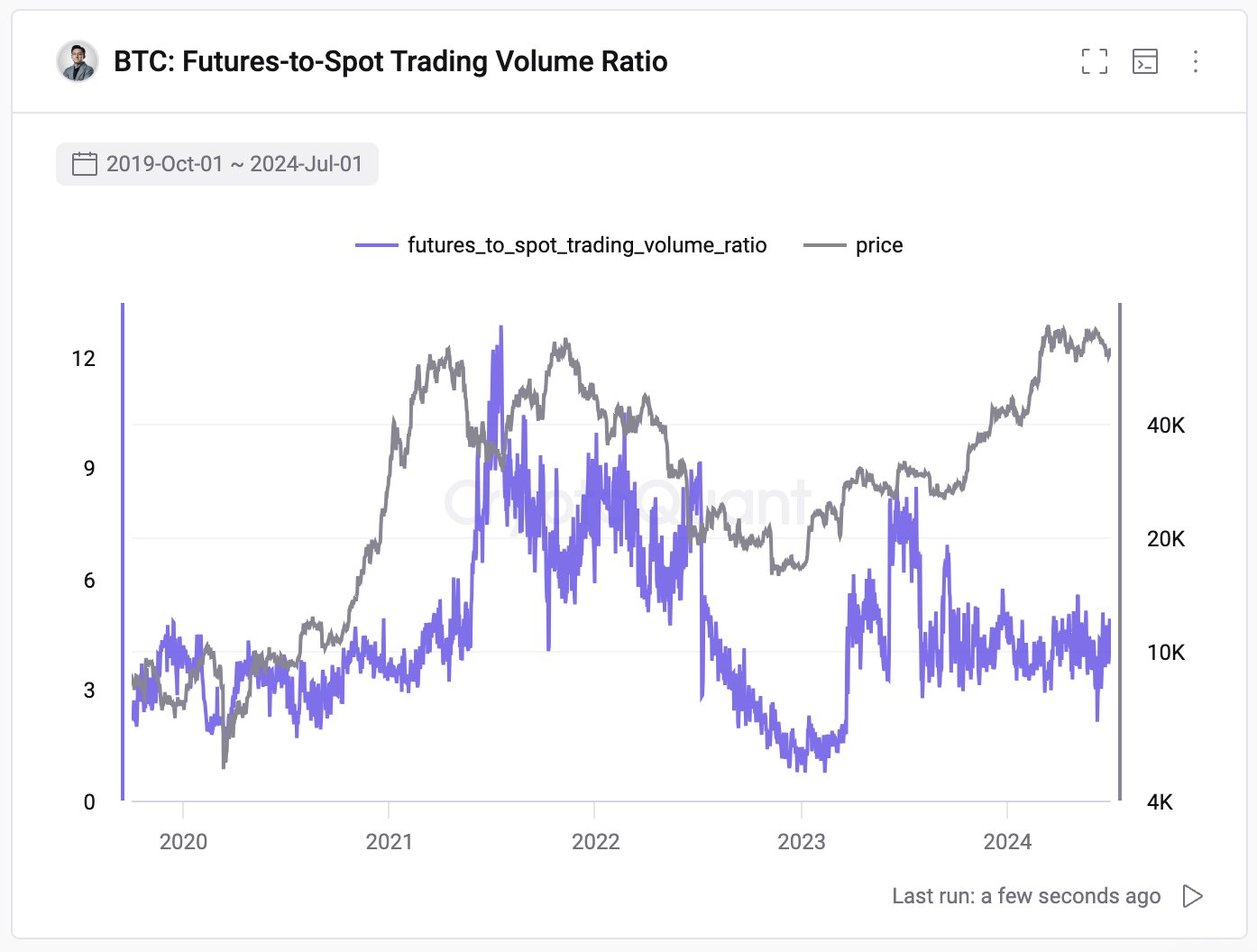

Now, right here’s a chart displaying how the Bitcoin futures to identify quantity ratio has trended over the previous few years:

The worth of the metric seems to have been shifting sideways in the previous few months | Supply: @ki_young_ju on X

The chart above reveals that the Bitcoin futures to identify quantity ratio surged to fairly excessive ranges in the course of the 2021 bull interval. Extra particularly, the indicator crossed the 12 mark throughout its peak, that means futures buying and selling quantity was greater than 12 occasions that of spot buying and selling.

Following this high, the indicator cooled considerably in the course of the second half of the 2021 bull market, however stays elevated. These excessive ranges then continued into the primary half of 2022.

Nonetheless, because the bear market lows approached, the indicator plummeted as curiosity in speculative exercise surrounding cryptocurrencies pale. With the restoration in 2023, the indicator recovered considerably and in June touched the identical degree as within the first half of 2022.

However the ratio has since fallen again to comparatively low ranges and has continued to consolidate round that degree thus far. In contrast with the height in 2021, the indicator worth has dropped by roughly 63%.

Futures buying and selling quantity remains to be the dominant pressure out there, however it’s a lot decrease than within the 2021 bull run, which implies that speculative curiosity has comparatively cooled in the course of the rally. The founding father of CryptoQuant believes that the development of elevated spot buying and selling quantity is sweet for the market.

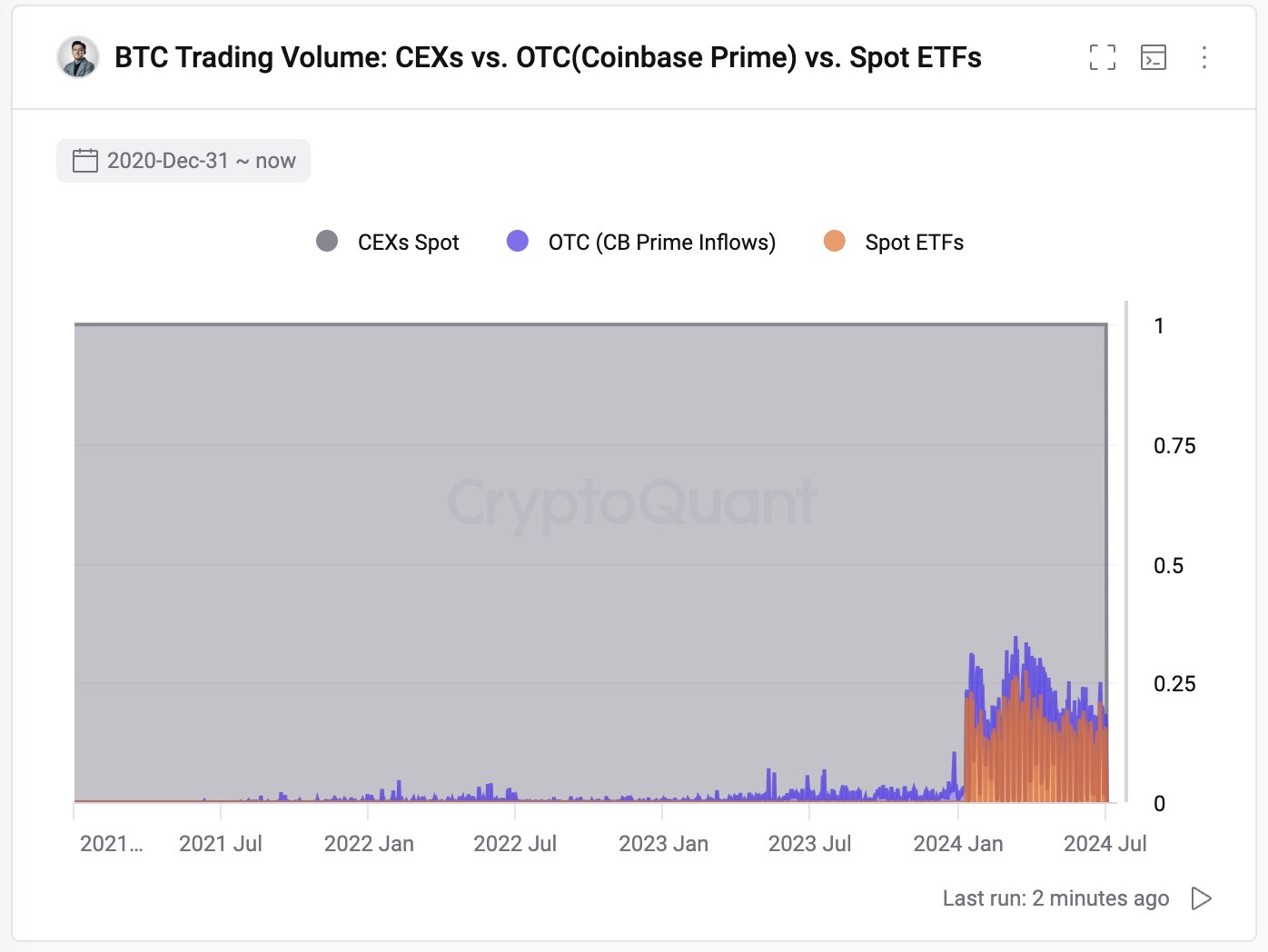

On this newest cycle, although, there’s one thing totally different: a brand new technique to commerce Bitcoin: spot exchange-traded funds (ETFs). So, how do buying and selling volumes in these monetary devices examine to the spot market?

As Ju identified in one other X put up, these ETFs at present account for nearly 1 / 4 of complete spot buying and selling quantity.

The ETF quantity of BTC stacked towards its spot buying and selling quantity | Supply: @ki_young_ju on X

bitcoin value

Bitcoin has plunged greater than 4% previously 24 hours, with the value falling to $57,300.

Seems like the value of the coin has been going downhill in current days | Supply: BTCUSD on TradingView

Featured pictures from Dall-E, CryptoQuant.com, charts from TradingView.com