Bitcoin costs have plummeted greater than 15% up to now 4 days, plummeting 7.8% up to now 24 hours. From a excessive of almost $72,000 in early June, the value of BTC has now fallen by almost 25%. Listed below are the important thing elements behind yesterday’s sharp value drop.

#1 Bitcoin Compensation at Mt. Gox

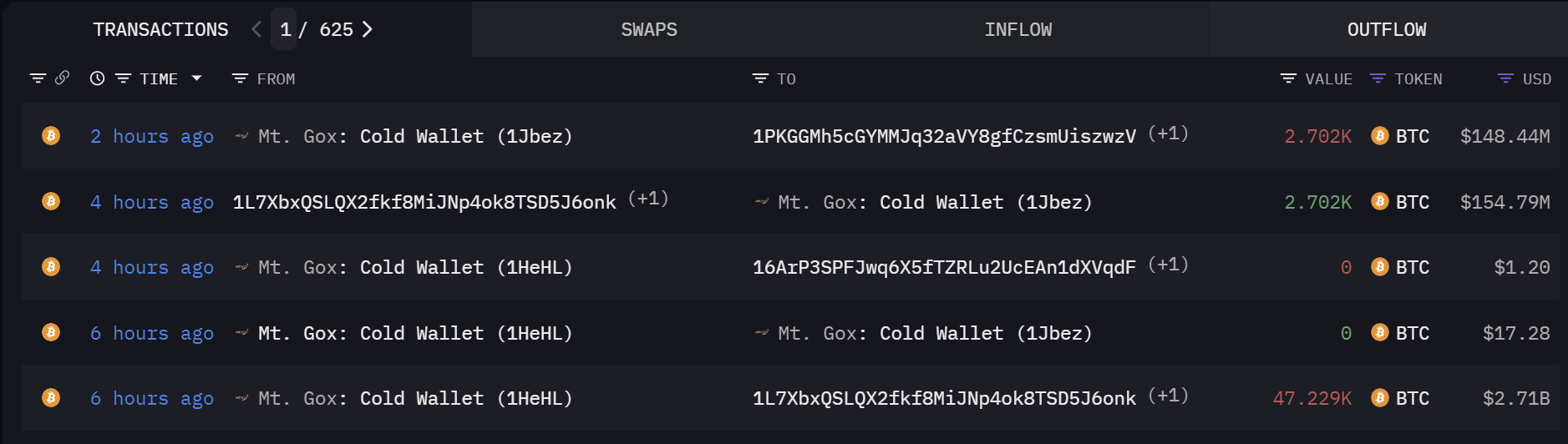

The defunct cryptocurrency change Mt. Gox is about to allocate 142,000 BTC, which has enormously stirred market nervousness. The quantity, which represents 0.68% of the full Bitcoin provide, is predicted to be distributed to collectors of the change, which ceased operations in 2014 following a significant hack.

A lot of transfers have already occurred in the course of the distribution, with 52,633 BTC moved in latest hours, indicating that preparations for large-scale funds are underway. Market watchers and analysts are watching these developments intently, as the opportunity of an enormous sell-off by these collectors may trigger appreciable volatility out there.

The psychological impression of this distribution may result in preemptive promoting by Bitcoin holders, additional fueling market jitters.

#2 German Authorities

The German authorities’s determination to start liquidating its Bitcoin holdings additionally brought on ripple results out there, with transactions recorded on main exchanges similar to Bitstamp, Coinbase and Kraken.

Associated Studying

Inside two weeks, the federal government’s holdings of Bitcoins fell from 50,000 to 42,274 Bitcoins. Market contributors are understandably involved that continued promoting by main holders similar to governments may result in downward strain on costs.

#3 Huge lengthy liquidation

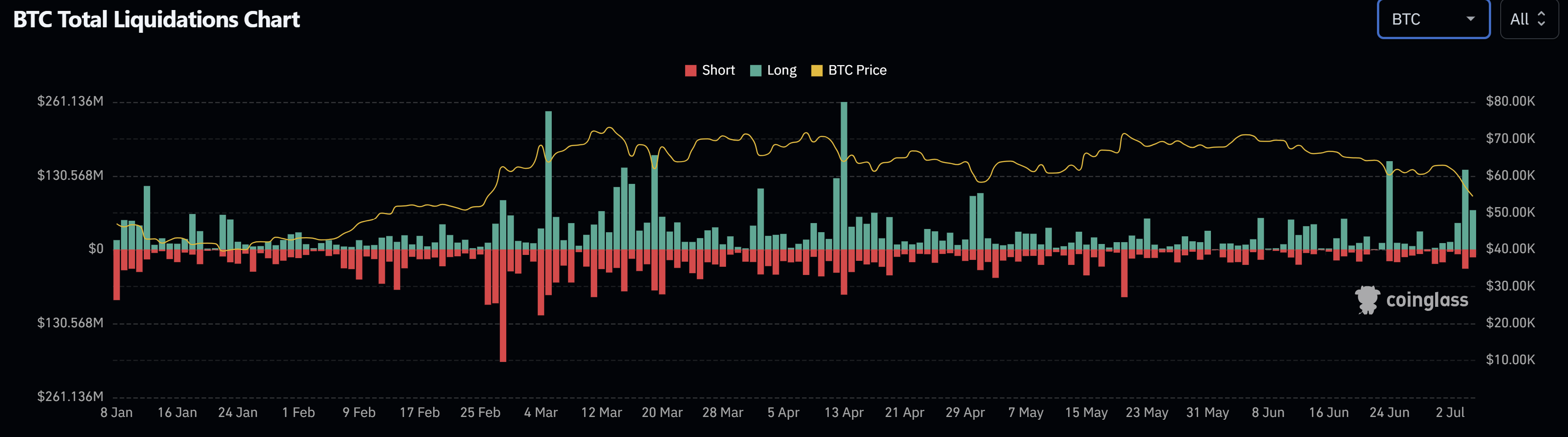

The Bitcoin market has seen a pointy enhance within the liquidation of lengthy positions, with the worth of BTC liquidated up to now 48 hours alone reaching a report $212 million. The liquidation is probably the most critical since April 13, when $261 million value of BTC longs have been liquidated, inflicting the value of Bitcoin to drop sharply from $68,500 to $61,600.

Such liquidations usually set off a sequence response that ends in pressured promoting and additional value declines. These liquidations present that the market is very leveraged and traders could also be overextended, exacerbating market volatility.

#4 BTC Miners Give up

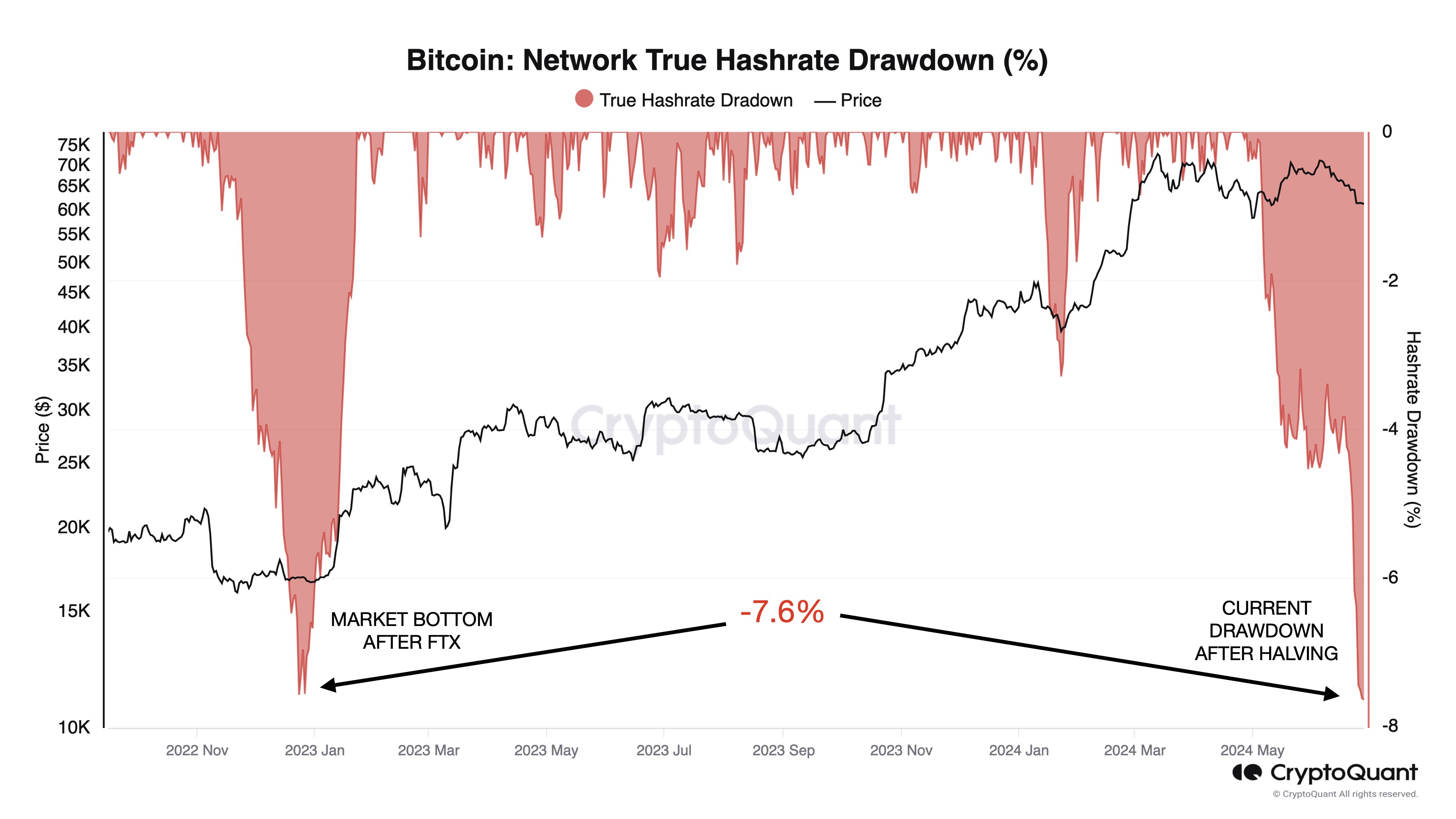

After the Bitcoin halving occasion on April 20, 2024, the mining reward was halved from 6.25 BTC to three.125 BTC, and the financial strain on miners continued to escalate. The discount in rewards was anticipated to extend the value of Bitcoin, however this enhance has not materialized, leading to diminishing returns for miners.

Associated Studying

Researchers at CryptoQuant just lately revealed that the present miner capitulation is much like earlier market bottoms, such because the one which occurred after the FTX crash. Indicators that miners are struggling embrace an enormous 7.7% drop in hash charge and a collapse in mining income per hash to close all-time lows, which means many miners have been pressured to close down tools and promote BTC reserves.

#5 US Spot Bitcoin ETF Exercise Slows

Opposite to expectations that institutional funding will drive market prosperity by way of spot Bitcoin ETFs, the expansion of the trade has slowed considerably. The anticipated “second wave” of institutional funding has thus far did not materialize, resulting in subdued exercise within the ETF house. In distinction, spot ETFs are at present experiencing a sluggish summer season season.

The keenness surrounding Bitcoin ETFs can’t offset the overwhelming detrimental market sentiment; nevertheless, its direct impression stays comparatively small. Main on-chain analyst James “Checkmate” Test just lately estimated that solely 20% of spot buying and selling quantity comes from spot ETFs, with the rest coming from conventional spot markets. Lengthy-term Bitcoin holders have offered off their holdings closely in latest weeks, a significant driver of downward strain available on the market.

At press time, BTC was buying and selling at $54,434.

Featured picture created with DALL·E, chart from TradingView.com