Solana (SOL) has seen a surge in buying and selling exercise, pushed by a wide range of optimistic components. This consists of massive purchase orders, savvy shopping for by institutional traders and the anticipated issuance of SOL-based exchange-traded funds (ETFs).

Associated Studying

Whales discretely consolidate SOL

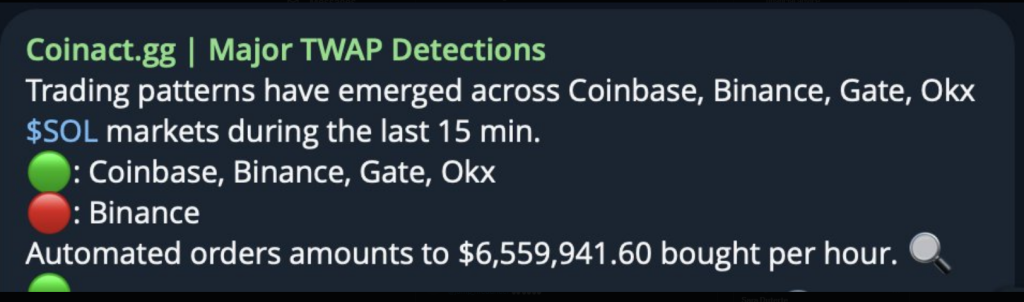

Buying and selling information exhibits vital will increase in buying and selling quantity on main exchanges akin to Binance, Coinbase, Gate.io, and OKX. Nevertheless, a deeper evaluation by reside buying and selling analysis program Coinact.gg revealed a really attention-grabbing sample: SOL’s “Predominant TWAP” sign.

Major TWAP detection alarm on $SOL. Greater patrons are accumulating $SOL #solana.

Buying and selling patterns have emerged in @coinbase , @binance , @gate_io , @okx $SOL Final quarter-hour of market

🟢️: Coinbase, Binance, Gate, Okx

🔴️: Binance

Automated orders are equal to… pic.twitter.com/TXpnfprQPn— MartyParty (@martypartymusic) July 10, 2024

Massive traders, particularly monetary establishments, usually make use of a method referred to as time-weighted common worth, or TWAP. A standard apply is to unfold a lot of purchase orders over a sure time period to cut back their influence on market costs.

Which means that institutional gamers are purposefully accumulating SOL with out inflicting massive worth actions, which is typical of a optimistic long-term outlook.

ETF hype sparks investor curiosity

Moreover, information {that a} SOL-oriented exchange-traded fund (ETF) could also be accessible in mid-March 2025 has aroused investor curiosity. The Bitcoin group is abuzz with pleasure and hypothesis because the Chicago Board Choices Change (CBOE) lately submitted a proposal to record exchange-traded funds (ETFs) provided by VanEck and 21Shares.

Solana Value Prediction

Many analysts anticipate SOL costs to proceed rising; others estimate a 17% rise by August 10 amid cautious optimism. Technical indicators additionally present a optimistic development.

Associated Studying

The Worry and Greed Index measures general market sentiment and the result’s “concern” (29). Which means that whereas traders have excessive hopes for SOL’s prospects, there are nonetheless sure basic points throughout the bigger crypto trade.

The disparity in Binance buying and selling statistics relative to different exchanges raises some questions. Extra analysis is required to search out the explanations for this totally different habits, as it might point out the existence of distinctive market dynamics, particularly on Binance.

The promise of ETFs to offer accessible, regulated SOL funding choices is attracting a brand new technology of traders, particularly these beforehand unwilling to barter the complexities of cryptocurrency buying and selling. The value of SOL has continued to rise by 8% on the weekly timeframe, reflecting this greater demand, permitting the community to maneuver again to the $142 stage.

Bolstered by a positive setting, Solana’s future seems vivid. Institutional investor curiosity, the potential of regulated ETFs and up to date worth positive aspects all current a optimistic outlook.

Featured photos from Pexels, charts from TradingView