Bitcoin spiraled downward within the first week of July, bottoming under $54,000 as some massive holders intensified promoting. Numerous studies utilizing on-chain information have blamed the sell-off on the sale of Bitcoin seized by the German state of Saxony earlier this yr.

Associated Studying

Regardless of such a heavy sell-off, Bitcoin has largely held its floor, with bulls managing to forestall the worth from falling additional. In line with on-chain information, Bitcoin’s deadlock could be attributed to some whales, as a lot of them took benefit of the worth drop so as to add extra Bitcoin. Notably, Bitcoin whales added 71,000 BTC to their wallets this week.

Bitcoin whales acquired 71,000 BTC this week

This week, Bitcoin whales went into an absolute feeding frenzy after amassing a whopping 71,000 BTC from cryptocurrency exchanges. Whereas Saxony, Germany is busy promoting off its cryptocurrency reserves, these massive gamers are more than pleased so as to add to their already large holdings.

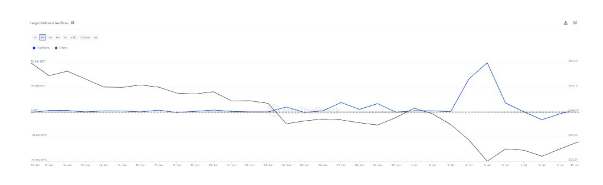

The whale’s fascinating exercise was first observed on social media platform X Enter the neighborhood. The chart under exhibits that the buildup of Bitcoin reached its peak throughout the interval when Bitcoin fell from US$63,600 on July 1 to US$53,905 on July 5, a drop of 15%.

Along with whale accumulation, spot Bitcoin ETFs have seen regular inflows this week regardless of falling spot costs. funds Recorded optimistic web site visitors There was site visitors every single day for every week, with the biggest web site visitors on July 12, reaching $310 million.

Bitcoin holds on

Saxony, Germany, bought greater than $2 billion value of Bitcoin final week, with a considerable amount of Bitcoin flooding into the market. When this sell-off first started, many merchants and market contributors expressed doubts that the already bearish Bitcoin may face up to the promoting stress. Many analysts even count on the worth to drop to $47,000. Different analysts, however, consider the sell-off is overblown.

Regardless of this back-and-forth, Bitcoin has managed to scale via the sell-off and take up its influence higher than many anticipated. This means that the cryptocurrency has now achieved stability, stopping additional value declines.

It additionally highlights the rising maturity of the cryptocurrency market, which has been characterised by excessive ranges of volatility for years. The $2 billion sell-off could be very small in comparison with Bitcoin’s $1.18 trillion market capitalization. Damaged down, this $2 billion solely accounts for lower than 0.2% of the whole market worth of Bitcoin.

Associated Studying

As of this writing, Bitcoin is buying and selling at $59,960. Bulls at the moment are eyeing one other break above $60,000. A breakout and maintain above $60,000 would set the stage for additional value positive factors within the week forward.

Featured picture through Getty Pictures, chart through TradingView