Based on the most recent on-chain observations, Bitcoin merchants’ realized losses have reached ranges which have repeatedly confirmed crucial to Bitcoin’s actions lately. This begs the query – has Bitcoin value bottomed?

Merchants’ realized losses are as soon as once more under -12 – what occurred final time?

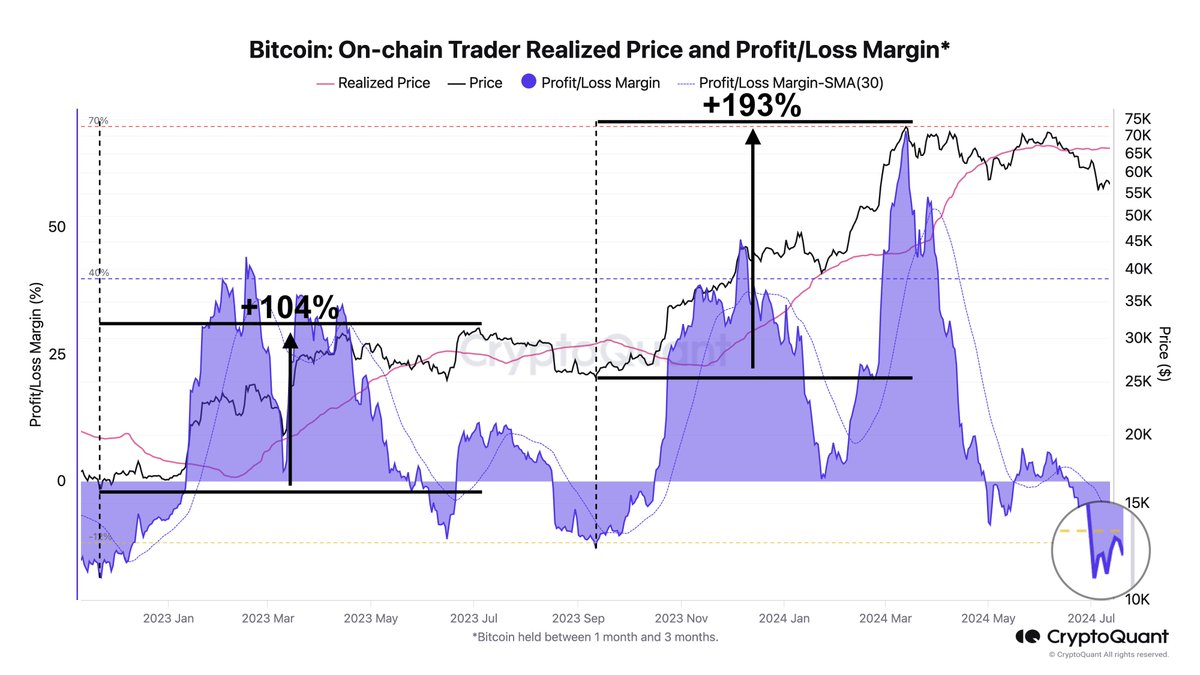

In a current article on Platform This on-chain revelation is predicated on the CryptoQuant Revenue/Loss Margin indicator, which aggregates income and losses from all Bitcoin trades.

Revenue/loss ratio mainly assesses the general profitability of buyers in a particular cryptocurrency, on this case Bitcoin. When the worth of this indicator is constructive, it signifies that extra BTC is being offered for revenue. Alternatively, adverse revenue/loss signifies that extra Bitcoins are being offered at a loss.

Based on CryptoQuant information, the revenue and loss margin is presently under the -12 mark, which means merchants are presently seeing extra losses than good points out there. Traditionally, this stage is extra necessary contemplating that the indicator has been under -12 in previous cycles.

Curiously, the current revenue/loss unfold under -12 was adopted by a interval of great bullishness in value. Because the chart highlighted by Martinez reveals, the final two occasions the indicator fell under this stage, costs rose by 104% and 193% respectively.

Supply: Ali_charts/X

If this historic sample follows, then Bitcoin’s value might expertise important bullish exercise within the close to future. Moreover, observing important losses out there can point out the underside of a bearish cycle and the start of a extra constructive section.

Bitcoin Value Surges? Listed here are the necessary ranges to be careful for

If the historic sample does maintain true and Bitcoin costs rise, there are a number of value areas price watching. Martinez stated the foremost cryptocurrency has main resistance ranges close to the $61,340 and $64,620 areas.

This revelation is predicated on the price foundation of Bitcoin buyers and the distribution of Bitcoin provide throughout totally different value ranges. The scale of the factors within the chart under displays the power of resistance and help and the quantity of BTC bought in every value space.

key resistance stage #bitcoin The quantities monitored had been US$61,340 and US$64,620. The important thing help stage to look at is $57,670! pic.twitter.com/YrBPkJmWzn

— Ali (@ali_charts) July 13, 2024

As of this writing, Bitcoin’s value is round $59,467, up 2.7% up to now 24 hours. Based on information from CoinGecko, the flagship cryptocurrency has gained 2% over the previous week.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured pictures from Pexels, charts from TradingView