After falling as little as $53,600 final Friday, Bitcoin value skilled a major restoration over the weekend, surpassing the $63,000 mark at the moment. That marked a pointy rise of 17% since Friday, reaching that stage for the primary time in two weeks. This rise might be attributed to a number of components which have mixed to drive the prime minister’s cryptocurrency costs increased.

#1 “Trump Bitcoin Surges”

Bitcoin’s value restoration coincided with the assassination of former president and 2024 presidential candidate Donald Trump. The incident has considerably affected his odds within the upcoming election, with betting market Polymarket at the moment predicting a 70% probability of victory.

Cryptocurrency knowledgeable Will Clemente III emphasised on In response, it seems that the market will start to cost in a complete Trump victory.”

Associated Studying

Macro analyst Alex Krüger elaborates on the impression of a Trump presidency on monetary markets: “Trump commerce is occurring now. That is what a Trump win or the expectation of him profitable will deliver.” Coming: Be bullish on cryptocurrencies because the Trump administration is more likely to search supportive regulation of cryptocurrencies to advertise innovation and adoption.

#2 German gross sales are exhausted

The large Bitcoin sell-off just lately accomplished by the German authorities has additionally contributed to the value restoration. Germany exhausted its cache of fifty,000 BTC seized from Movie2k, with a last transaction of 3846.05 BTC being accomplished on Friday.

Main on-chain analyst James “Checkmate” Verify mentioned of the unbelievable energy of BTC costs on 25%, this can be a very structured and orderly adjustment. The final time one thing related occurred, LUNA offered about $80,000 of BTC, and the value fell from $46,000 to $25,000, after which to $17,000 shortly after. {dollars}. Not the identical.

#3 US Greenback Index Weak spot

A weaker U.S. greenback might be one other driver of Bitcoin’s current beneficial properties. The U.S. Greenback Index (DXY), which measures the dollar in opposition to a basket of main currencies, has fallen 1.8% over the previous two weeks to a five-week low of 104.

Associated Studying

Expectations of rate of interest cuts and the rising U.S. authorities deficit, which has reached $1.27 trillion thus far in June, have induced the greenback to weaken, prompting buyers to show to riskier property corresponding to Bitcoin and cryptocurrencies.

#4 Bitcoin Miners Give up Ends

One other well-known cryptocurrency analyst, Joe Burnett, confused yesterday through Traditionally, the top of miner capitulation has been related to subsequent value will increase.

#5 Technological Breakthroughs

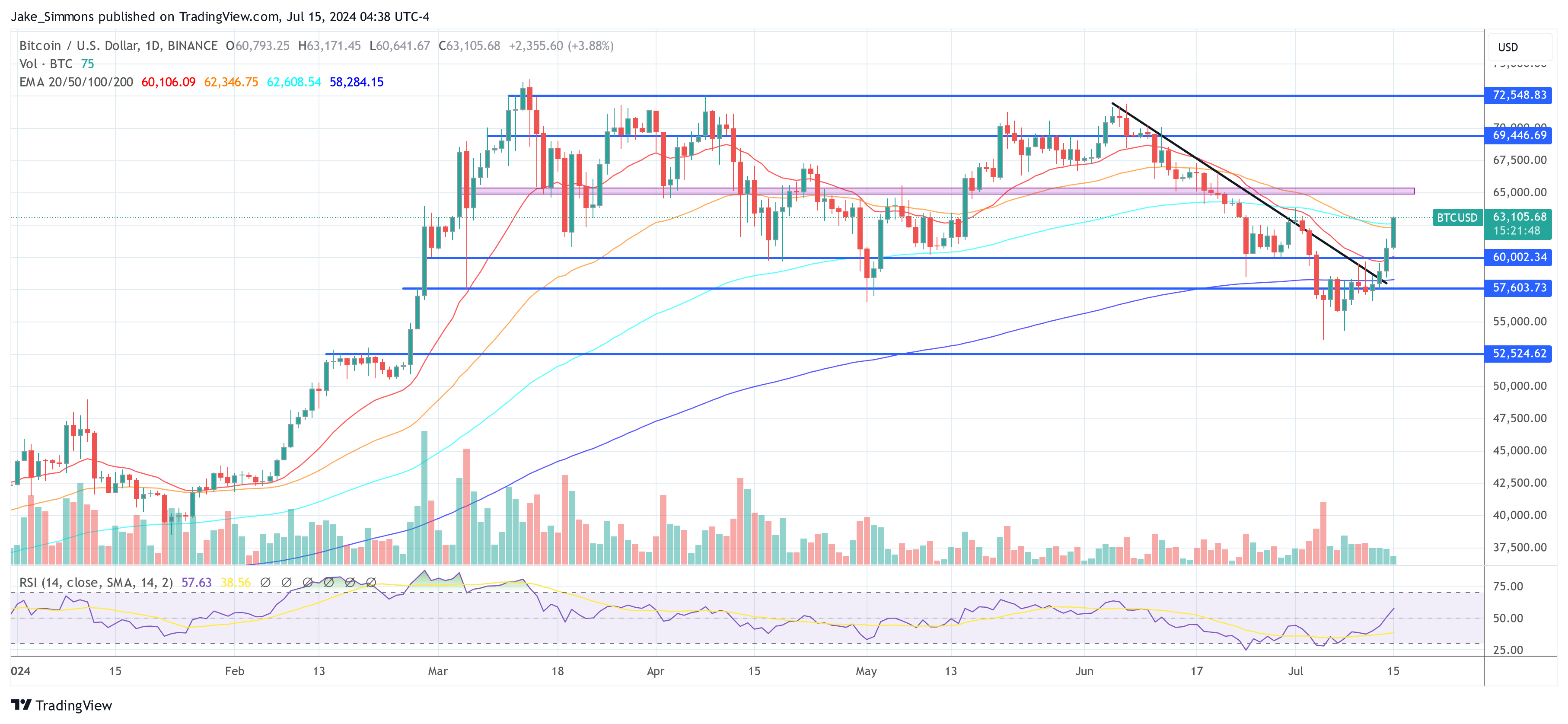

From a technical perspective, Bitcoin broke above the important thing 200-day exponential shifting common (EMA) and downtrend line on Saturday. This milestone might be considered as a bullish sign to merchants, indicating that the downturn that started in early June could also be over.

At press time, BTC was buying and selling at $63,105.

Featured picture created with DALL·E, chart from TradingView.com