Because the extremely anticipated Ethereum ETF spot launch date approaches, Matt Hougan, chief funding officer of crypto asset supervisor Bitwise, highlights the potential of those tasks ETF inflows Pushing the worth of Ethereum to an all-time excessive.

In a current consumer observe, Hougan highlighted the numerous influence that ETF flows may have on Ethereum costs, much more so than the U.S. spot Bitcoin ETF market.

Is Ethereum ETF anticipated to surpass Bitcoin in affect?

Hogan confidently predict The introduction of a spot Ethereum ETF will trigger the worth of ETH to surge, doubtlessly reaching all-time highs above $5,000. Nevertheless, he warned that the primary few weeks after the ETF launch may very well be risky as funds may circulation out of the present $11 billion Grayscale Ethereum Belief (ETHE) after it converts to an ETF.

This may very well be just like what occurred with the Grayscale Bitcoin Belief (GBTC), which noticed huge outflows of over $17 billion within the aftermath of the 2017 monetary disaster. Bitcoin ETF The market was accepted in January and the primary influx was recorded 5 months afterward Could 3.

Nonetheless, Hougan expects long-term market stability, pushing Ethereum to new all-time highs earlier than the top of the 12 months after preliminary outflows subside, and compares it to Bitcoin on key metrics to know this thesis.

Associated Studying

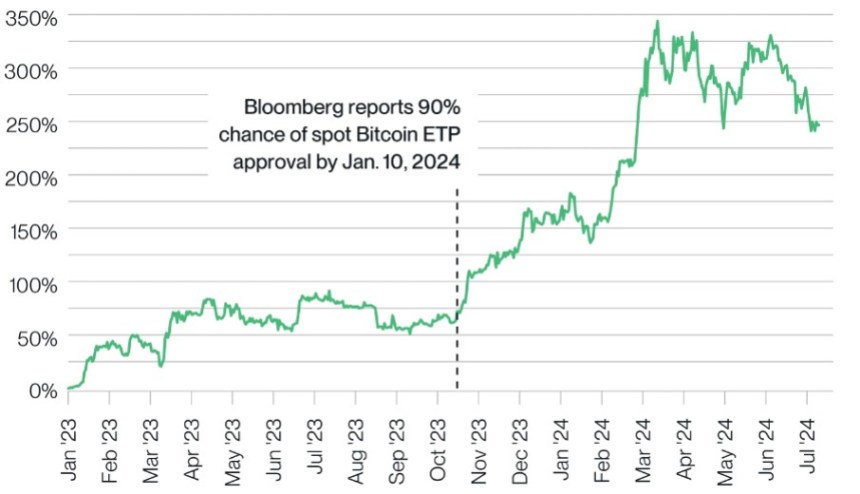

For instance, the Bitcoin ETF bought greater than twice the variety of Bitcoins miners produced throughout the identical interval, leading to a 25% improve within the variety of Bitcoins. Bitcoin worth For the reason that ETF’s launch, it is up 110% because the market started pricing in October 2023.

Nonetheless, Hougan believes the influence on Ethereum may very well be extra important, pointing to 3 structural the explanation why Ethereum ETF inflows may have a much bigger influence than Bitcoin.

Decrease inflation, staking benefit and shortage

The primary cause emphasised by the Chief Info Officer of Bitwise is that Ethereum is low within the quick time period. Inflation fee. When the Bitcoin ETF was launched, Bitcoin’s inflation fee was 1.7%, whereas Ethereum’s inflation fee over the previous 12 months was 0%.

The second cause lies within the distinction between Bitcoin miners and Ethereum stakers. Because of the charges related to mining, Bitcoin miners Usually promote a lot of the Bitcoins they purchase to cowl working prices.

In distinction, Ethereum depends on a proof-of-stake (PoS) system the place customers use ETH as collateral to precisely course of transactions. ETH stakers don’t incur excessive direct prices and are usually not compelled to promote the ETH they earn. Consequently, Hougan believes that each day compelled promoting strain is decrease on Ethereum than on Bitcoin.

Associated Studying

The third cause stems from the truth that a good portion of ETH is staked and subsequently can’t be offered. At present, 28% of ETH is staked and 13% is locked in good contracts, successfully eradicating it from the market.

This resulted in roughly 40% of the ETH not being instantly accessible on the market, leading to appreciable losses. lack In the end favoring a possible improve within the worth of the second-largest cryptocurrency available on the market, relying on recorded outflows and inflows. Hogan concluded:

As I discussed above, I count on the brand new Ethereum ETP to achieve success, accumulating $15 billion in new property throughout the first 18 months of itemizing…if the ETP is as profitable as I count on, and on condition that With the above dynamics, it’s tough to think about that ETH is not going to problem its previous file.

ETH is buying and selling at $3,460, up 1.5% up to now 24 hours and practically 12% up to now seven days.

Featured pictures from DALL-E, charts from TradingView.com