Bitcoin’s value has staged a reasonably important rally over the previous few days, rising from final week’s low of $53,000 to a peak buying and selling value of over $66,000 within the early hours of Wednesday morning earlier than falling again to its present buying and selling value of $64,433.

This bullish value efficiency led to the downfall of roughly 50,436 merchants within the crypto market immediately. Specifically, this variety of merchants noticed huge liquidations, bringing the present whole to $145.58 million, in line with Coinglass knowledge.

Bitcoin merchants have borne the brunt of this sweeping liquidation, with about $46.22 million evenly break up between quick and lengthy positions, indicating the asset’s blended strikes prior to now day alone.

Associated Studying

Bitcoin: An even bigger reckoning is coming

Whereas latest buying and selling exercise has triggered multi-million greenback liquidations, additional knowledge suggests this might escalate dramatically into billions if Bitcoin continues to climb to new all-time highs and breach important ranges.

Specifically, in line with MartyParty, a widely known cryptocurrency fanatic in the neighborhood, the market will really feel the impression if the worth of Bitcoin hits $72,400, with practically $19 billion in Bitcoin quick positions able to be liquidated at this value level.

Marty Social gathering reported this on Elon Musk’s social media platform X, citing knowledge from Coinglass. The cryptocurrency fanatic concluded the disclosure by stating: “By no means guess towards know-how.”

How lengthy will this liquidation take?

Whereas a value of $72,400 appears distant from present market costs, it could not take that lengthy for Bitcoin to achieve this stage given present fundamentals. For instance, the market could also be drawn so far extra rapidly as a result of that is the place liquidity is driving the present pattern.

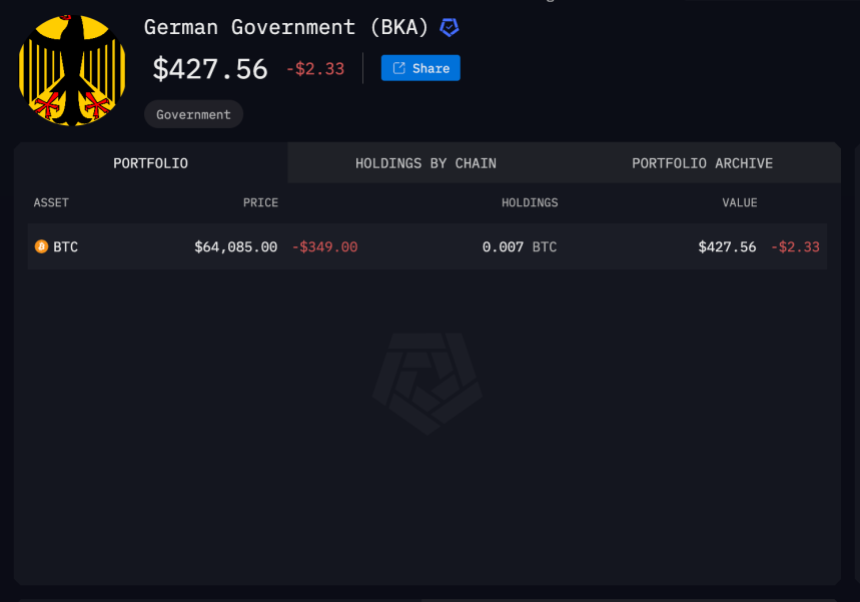

Past that, we don’t see any bears slowing the asset’s beneficial properties within the close to time period. First, in line with knowledge from Arkham Intelligence, the German authorities has bought all of its BTC holdings, roughly 49,858 BTC, and the present steadiness is beneath $500.

Notably, the present BTC steadiness price roughly $427 is the results of amassed sats (small models of BTC) donated from numerous pockets addresses. Moreover, in line with the newest knowledge from CryptoQuant, 36% of Mt.Gox BTC has been distributed to collectors.

Nevertheless, regardless of this distribution, the worth of Bitcoin has but to see any important correction, which signifies two issues: collectors are usually not promoting, and even when they’re, the Bitcoin market is rapidly absorbing it, which is mirrored within the value of Bitcoin A slight stabilization will be seen.

Associated Studying

These huge sell-offs by the German authorities and Mt. Gox have been as soon as thought of main threats to the cryptocurrency market, however now seem to have minimal impression, suggesting there aren’t any main bearish limitations stopping Bitcoin from surging to the $72,400 mark, inflicting a brief squeeze .

Featured picture created utilizing DALL-E, chart from TradingView