With the large Bitcoin sell-off, Germany has basically modified the state of affairs for Bitcoin. Germany lately bought off a staggering 49,850 Bitcoins in a matter of weeks. These trades are executed on many exchanges equivalent to Coinbase, Kraken and Bitstamp, serving to to cut back potential lack of worth.

Associated Studying

Apparently, the German authorities began these gross sales out of worry of a major drop within the worth of Bitcoin. Bitcoin’s common worth is round $57,000, with complete good points simply over $2.8 billion.

Fascinatingly, Germany misplaced an extra $400 million in potential good points, whereas Bitcoin is at the moment price $66,425. Germany now holds lower than one Bitcoin.

The U.S. authorities’s strategic transfer towards Bitcoin?

Because the mud settles on Germany’s huge Bitcoin sell-off, the US authorities has been within the information for its sensible Bitcoin strikes.

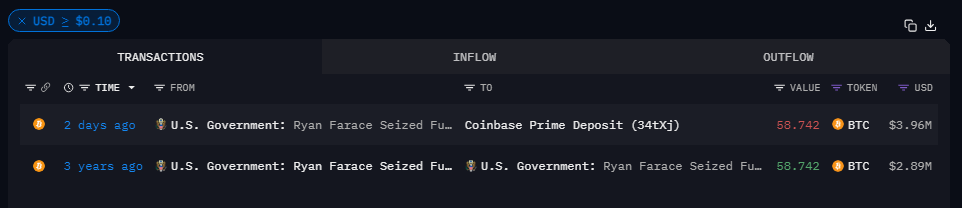

Blockchain intelligence platform Arkham Intelligence found a noteworthy transaction on July 22, 2024 involving the switch of 58.742 BTC from a authorities pockets to Coinbase Prime Deposit. The transfer, price roughly $4 million, has sparked curiosity and concern within the crypto neighborhood.

The USA holds roughly 213,200 Bitcoins valued at roughly $14.4 billion, most of that are property seized from legal entities. Probably the most broadly recognized of those was the 69,370 Bitcoins seized in August 2023 from the notorious Silk Highway case.

What’s much more fascinating is that this newest transfer comes on the heels of a earlier transaction that occurred on June 26, when the U.S. authorities moved 4,000 Bitcoin to the identical Coinbase pockets.

Some worry the U.S. might observe Germany’s lead and start a large sell-off in response to those developments.

Bitcoin Traits in Germany and the USA: Market Affect

Traders and market consultants didn’t miss the federal government’s huge modifications to Bitcoin. The sell-off in Germany has proven that these insurance policies can have a major affect on investor confidence and market stability. Considerations about comparable actions by the U.S. authorities add one other layer of uncertainty to the market.

Associated Studying

Bitcoin costs have risen and fallen sharply, so market sentiment has been tight. Bitcoin is at the moment promoting for $66,420, which exhibits how the market feels about these authorities actions. It fell greater than 2% prior to now 24 hours.

These modifications are inflicting a reassessment of investor methods. Whereas some see the federal government sell-off as an indication of warning, others see it as the opportunity of a market correction. The state of cryptocurrencies continues to be largely influenced by the actions of huge Bitcoin holders, particularly governments.

Featured pictures from Pexels, charts from TradingView