Even after the U.S. Securities and Alternate Fee (SEC) authorized the spot Ethereum ETF record and buying and selling on July 23, Ethereum costs remained steady at spot costs and fluctuated horizontally.

At press time, Ethereum was trending beneath the important thing resistance ranges of $3,500 and $3,700. Nonetheless, patrons stored the worth above $3,300 as the worth motion moved sideways.

Whereas volatility is anticipated based mostly on choices information, now that the spot Ethereum ETF is obtainable for buying and selling, one analyst has pointed to a key growth that might influence BTC-ETH dynamics.

Ethereum whales take away, ETH outperforms BTC

In an article on X, Santiment information confirmed a rise in whale exercise forward of the US Spot Ethereum ETF. The analytics platform stated that since July 17, a number of high-value ETH transfers have been transferring sooner than what is often seen on Bitcoin and USDT.

This uncommon improve in transfers could point out rising confidence in Ethereum and ETH’s long-term prospects. One other crypto spinoff has even accelerated this course of, providing a substitute for Bitcoin.

Wanting on the ETHBTC value chart, it’s clear that ETH bulls have the higher hand. After falling in late June, the coin continued to outperform Bitcoin and posted a pointy rise on July 23. revenue.

ETH discovered help on the 50% Fibonacci retracement of the Could 2024 buying and selling vary, confirming the uptrend. Even so, for Could patrons to take management, bulls should clear 0.057 BTC, setting the stage for additional positive factors in the direction of the 2022-record 0.08 BTC.

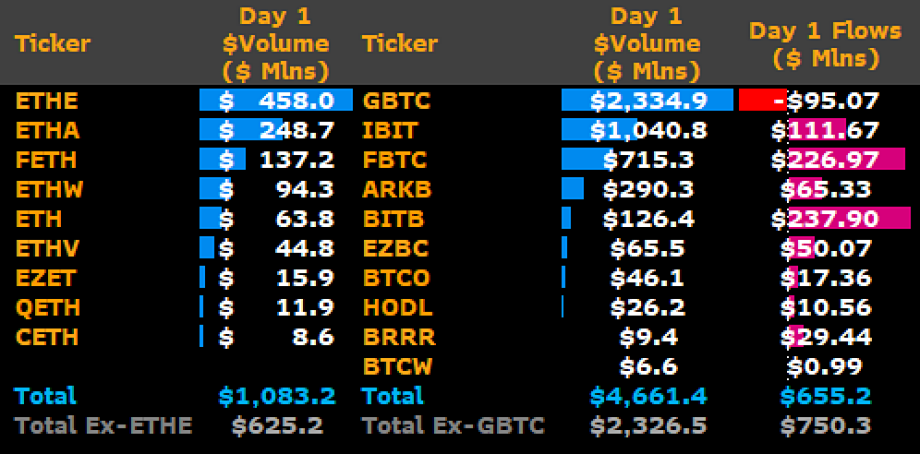

Spot ETF shares commerce price over $1 billion

Inflows into spot ETFs will drive the bull market. As seen with Bitcoin, value efficiency relies upon closely on the curiosity of institutional gamers. In lower than 24 hours after the product launched in america, varied issuers bought $1.1 billion in ETH.

Inflows are more likely to improve when ETH value breaks via current resistance, ideally final week’s excessive of $3,700. Bitwise analysts stated that with costs presently stagnant, the launch of the product solidifies Ethereum’s place because the foundational know-how for web3.

Bitwise analysts added that from the angle of the fast progress of the digital financial system, Ethereum will see the catalytic growth of sensible contract platforms.