As Bitcoin Convention 2024 approaches, expectations for Bitcoin are excessive, not solely resulting from technological developments but in addition the shocking help of an influential determine, Donald Trump.

Associated Studying

The previous president’s shocking embrace of Bitcoin may change the cryptocurrency scene and forged a long-term shadow on political debate and market forecasts. Right here’s how a possible Trump presidency may affect the route of cryptocurrencies.

Trump’s Bitcoin Reversal

Donald Trump was as soon as a vehement opponent of Bitcoin, however his language has modified dramatically. His marketing campaign has even recommended Bitcoin as a attainable reserve forex alongside the U.S. greenback, and his marketing campaign has actively embraced the digital asset. This new enthusiasm is a giant departure from his previous angle, when he wrote about Bitcoin as a “rip-off.”

In current discussions, the previous president referred to Bitcoin as “digital gold.” His marketing campaign vowed to extend the acceptability of digital belongings. This might deliver extra confidence to firms and buyers, thereby rising Bitcoin’s enchantment.

Regulatory adjustments and financial impacts

Trump’s probably affect on Bitcoin will largely rely upon his stance on regulation. Given J.D. Vance’s pro-crypto stance, Trump’s selection of working mate suggests there might be a tsunami of favorable cryptocurrency legal guidelines. Clearer guidelines and extra institutionalized Bitcoin investing might discover a approach out of this regulatory setting.

One other essential think about Bitcoin worth dynamics might be Trump’s financial plans. His platform emphasizes decreasing inflation and rising financial stability—qualities that instantly affect Bitcoin’s worth.

Trump’s financial insurance policies have been blamed for the comparatively secure funding setting throughout his time period as president. If he succeeds in creating a greater financial setting, Bitcoin will profit from extra liquidity and investor confidence.

Conjecture and market response

The Bitcoin market is pushed by hypothesis, so Trump’s shut relationship with the crypto asset amplifies that affect. Current occasions, equivalent to Trump’s tried homicide, have proven how violently market sentiment can react to political adjustments. Cryptocurrency costs surged following the incident; meme cash and market sentiment mirrored the large dangers of Trump’s involvement.

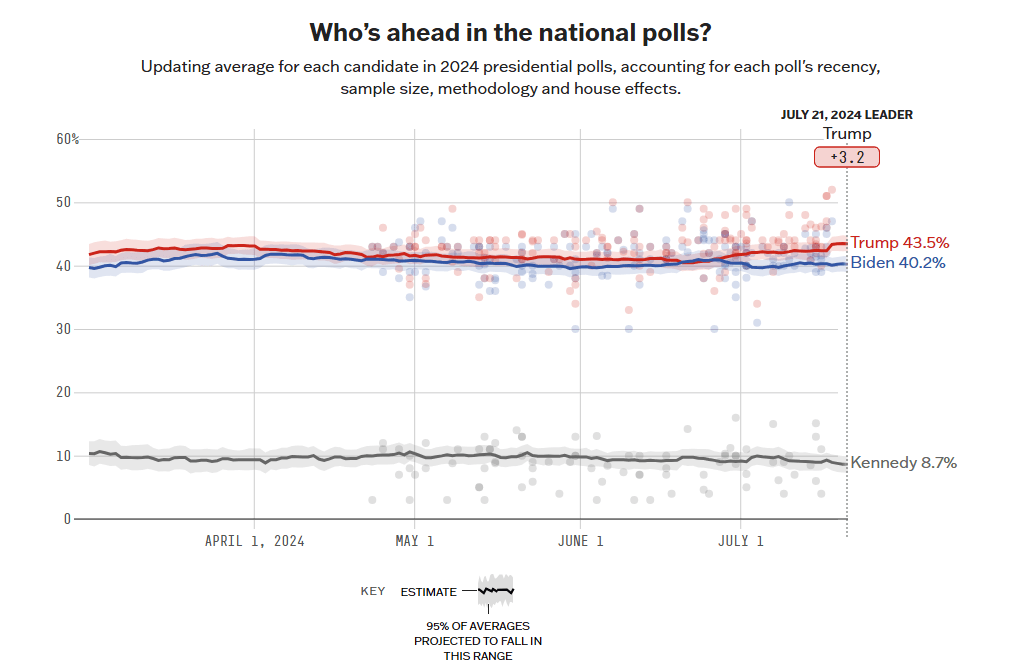

In the meantime, the previous commander-in-chief’s help for Biden has elevated following the assassination try (see chart beneath).

Trump’s erratic political path has fueled extra hypothesis about his attainable administration. At the same time as Kamala Harris emerges as a critical contender, the end result of the election stays unknown. Harris’ views on Bitcoin may affect market dynamics, additional complicating the forex’s future.

Because the election approaches, analysts are divided on the affect a Trump victory may have on the worth of Bitcoin. Whereas some see Bitcoin probably surging above $100,000 as a optimistic development, others stay cautious, anticipating extra strong indicators of Trump’s marketing campaign and plans.

Bitcoin Value Prediction

Technical indicators recommend Bitcoin will surge greater within the coming week. The cryptocurrency is buying and selling 33% beneath our month-to-month forecast and is anticipated to stage a comeback if market circumstances enhance. Bullish indicators equivalent to rising transferring averages and a strengthening relative power index (RSI) imply BTC might appropriate its undervaluation and attain the expected worth goal.

Associated Studying

Bitcoin is anticipated to rise 536% in three months and 53% in six months, displaying investor confidence. Analysts count on BTC to develop 148% in a single 12 months, indicating its long-term potential. A optimistic trendline break and strong help help this prediction. Institutional curiosity and favorable macroeconomic circumstances are prone to push Bitcoin’s worth greater in the long run.

Featured picture through Getty Pictures, chart through TradingView