The California Supreme Court docket dominated Thursday that Proposition 22 — the November 2020 poll measure that categorised app-based gig employees as unbiased contractors somewhat than staff — will stay in place.

The choice is a win for app-based corporations like Uber, Lyft, DoorDash and Instacart, which have struggled to take care of their enterprise fashions that depend on gig employees to supply passengers with on-demand rides and ship meals and different items .

“Whether or not drivers or couriers select to earn only a few hours per week or extra, the liberty to work when and the way they need is now firmly enshrined in California regulation, ending the overwhelming stress on them to undertake their employment A deceptive try at a sample.

Whereas the Supreme Court docket’s ruling can nonetheless be appealed, the ruling resolves, at the least for now, a long-standing court docket dispute surrounding California’s gig employee classification.

A 12 months after 58% of California voters voted in favor of Proposition 22, a Superior Court docket decide dominated that the proposal was unconstitutional and due to this fact “unenforceable.” Choose Frank Roesch stated on the time that Proposition 22 restricted the state Legislature’s energy and skill to go future laws.

As an alternative, Thursday’s Supreme Court docket ruling discovered that classifying app-based drivers as unbiased contractors doesn’t battle with a provision of the California Structure that provides the Legislature employees’ compensation authority. This upholds the March 2023 ruling by the California Court docket of Appeals that overturned the Roesch ruling.

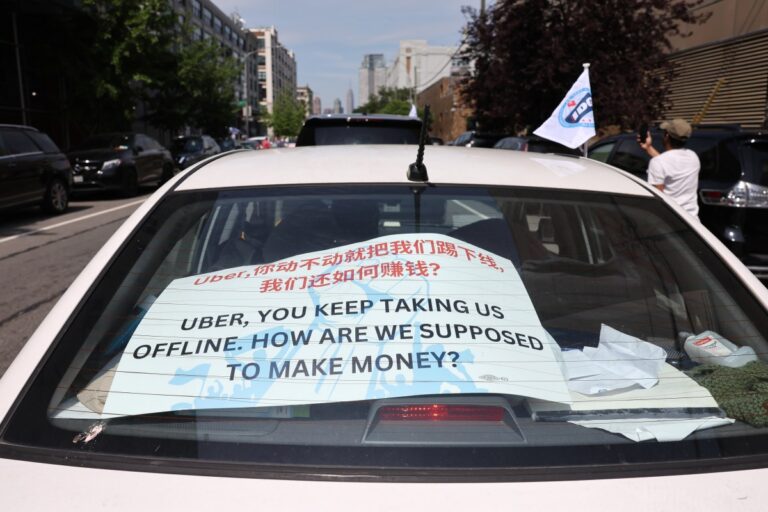

Proposition 22 is Uber, Lyft, DoorDash and Instacart’s response to Meeting Invoice 5, a state regulation requiring corporations to categorise these employees as staff, entitle them to minimal wage, employees’ compensation and Different advantages.

Collectively, the businesses have spent greater than $200 million on promoting to persuade drivers and California voters that Proposition 22 is of their finest pursuits.

These app-based corporations constructed their complete enterprise fashions on the belief that they would not must pay for the medical insurance, sick depart, and different providers they supply to their full-time staff. Their asset-light fashions depend on gig employees utilizing their very own automobiles to haul folks and ship meals, which is central to every firm’s purpose of conserving capital spending low and increasing broadly.

Proposition 22 makes an attempt to seek out some center floor between offering jobs for employees and permitting them to proceed working as unsupported contractors. Beneath Proposition 22, employees are eligible to earn 120% of the state minimal wage for hours labored, plus 30 cents per mile, adjusted for inflation after 2021. Adjusted for inflation, gig employees ended up paying again thousands and thousands in unpaid automobile payments final 12 months.

Nevertheless, the so-called minimal wage solely applies if the employee is actively engaged in work and doesn’t compensate drivers for the time they anticipate work. These corporations depend on staff hanging out and able to take jobs to be able to preserve a status for offering on-demand providers.

Critics argue that the earnings assure doesn’t truly give drivers a minimal wage after taking into consideration work-related bills corresponding to automotive upkeep, fuel and insurance coverage.

Proposition 22 additionally gives well being subsidies to drivers who work a sure variety of hours per week, however drivers instructed TechCrunch it is tough to qualify for these subsidies. The Rideshare Man contributor Sergio Avedian stated drivers should work 15 hours per week to obtain half the stipend and 25 hours per week to obtain the total stipend.

This story is growing. Please examine again for updates.