On-chain knowledge reveals that Bitcoin is retesting traditionally necessary assist ranges after the asset’s newest plunge in worth.

Bitcoin is at present retesting realized costs for short-term holders

As CryptoQuant neighborhood supervisor Maartunn explains in a brand new article on

The “precise worth” right here refers to an on-chain metric that, merely put, tracks the acquisition worth or price foundation of the common investor within the Bitcoin house.

When the worth of this indicator is larger than the spot worth of the cryptocurrency, the holder is at present in a state of lower than web loss. Then again, being beneath the asset worth means earnings dominate the market.

Within the context of the current dialogue, we’re involved not with the precise worth of the complete market, however with the precise worth of 1 a part of it: short-term holders (STH). STH consists of all buyers who bought BTC previously 155 days.

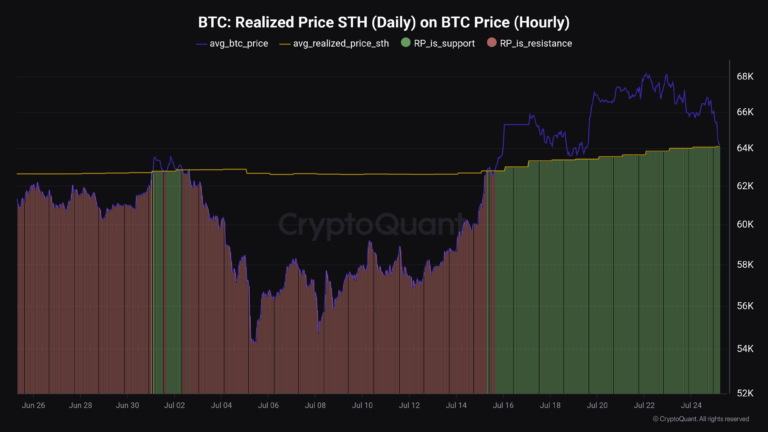

Now, the chart beneath reveals the Bitcoin realized worth development of STH over the previous month:

The chart above reveals that Bitcoin spot costs have realized worth declines in the direction of STH through the current decline. Because of this STH’s breakeven level is now being retested.

Traditionally, this sort of retesting has confirmed to be crucial for cryptocurrencies. This line is the transition boundary between bearish and bullish intervals.

Usually talking, when the asset is in an space above the STH realized worth, a retest of the indicator will trigger it to reverse. Likewise, when the coin is beneath this line, the road acts as resistance. The reason behind this unusual sample might lie in investor psychology.

STH is a fickle hand out there and so they react simply to adjustments in property. Due to this fact, they’ll naturally be delicate to price foundation retesting and should take motion when testing happens.

When sentiment within the sector is bullish, STH sometimes views its price foundation as a shopping for alternative. That is why this degree acts as assist throughout bullish intervals. During times of bearish sentiment, these buyers might panic promote at breakeven factors, posing resistance to the asset.

Bitcoin spot worth managed to interrupt above this resistance degree earlier this month, however it’s now retesting it once more because it plummeted. It stays to be seen whether or not assist will maintain, confirming the prevalence of bullish sentiment, or whether or not a breakdown beneath assist will sign a transition to a bearish market.

bitcoin worth

As of this writing, Bitcoin is buying and selling round $64,800, down greater than 2% previously 24 hours.