Bitcoin’s latest worth motion has been a curler coaster trip, with highs and lows. Nevertheless, regardless of Bitcoin’s all-time highs and near-constant constructive development over the previous two years, we now have but to see a sustained inflow of retail traders. Many traders are anxiously anticipating the potential for a surge in retail participation and the opportunity of boosting Bitcoin costs to unprecedented ranges. On this article, we’ll discover after we’ll see these retail traders leap again into the Bitcoin pool, and whether or not their returns can certainly propel Bitcoin to better heights.

Lively tackle progress and its influence

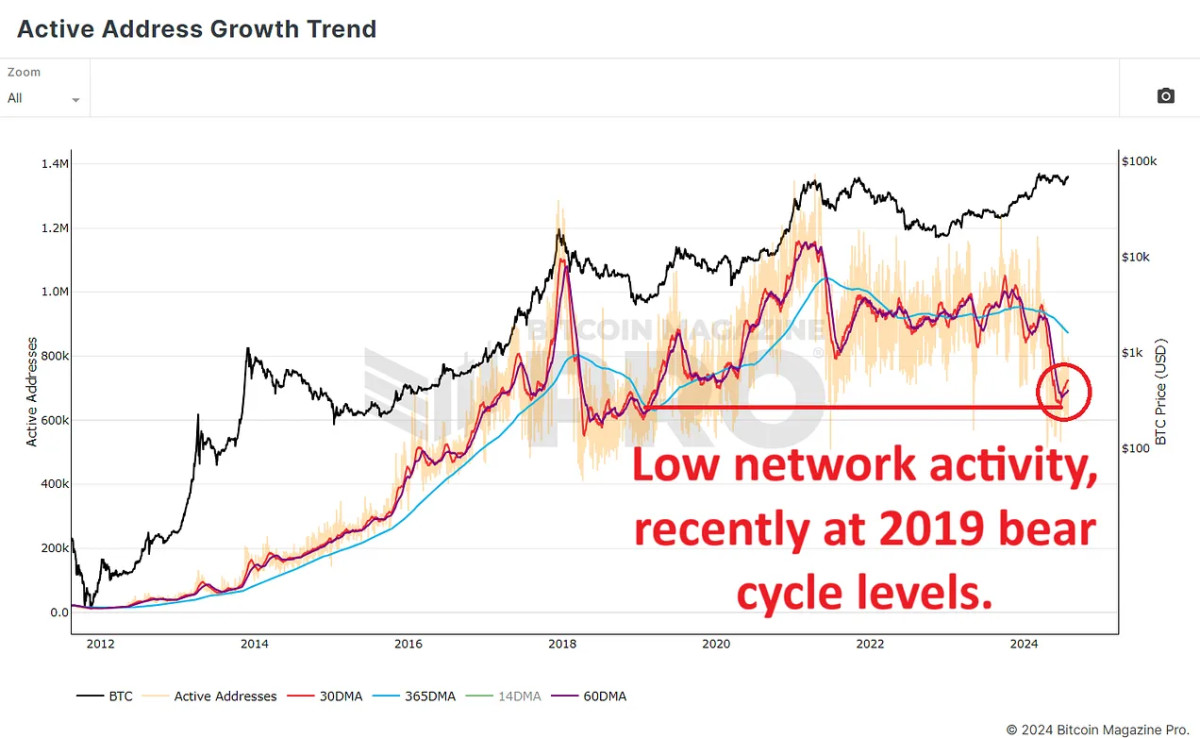

With a purpose to anticipate this potential retail wave, it is very important rigorously research the traits in lively tackle progress. Information from Bitcoin Journal Professional reveals that the variety of lively community individuals has declined in latest months. 365-day shifting common (blue line), and 60 days (purple line) and the 30-day common (crimson line), tells the story of declining on-line exercise. The decline brings the variety of lively customers again to ranges seen following Bitcoin’s bear market cycle in early 2019, when costs hovered between $3,500 and $4,000.

The decline in lively web customers has raised considerations about Bitcoin’s upside potential within the present cycle. Apparently, regardless of Bitcoin setting a brand new document of round $74,000, there was no corresponding continued progress in on-line customers, which is totally totally different from earlier cycles.

Mandatory influx of recent capital

This development might mirror Bitcoin’s altering id. Initially a digital peer-to-peer foreign money, Bitcoin is more and more considered as a retailer of worth. In consequence, fewer and fewer persons are utilizing it for day by day transactions and are as a substitute placing their cash into Bitcoin as a long-term asset.

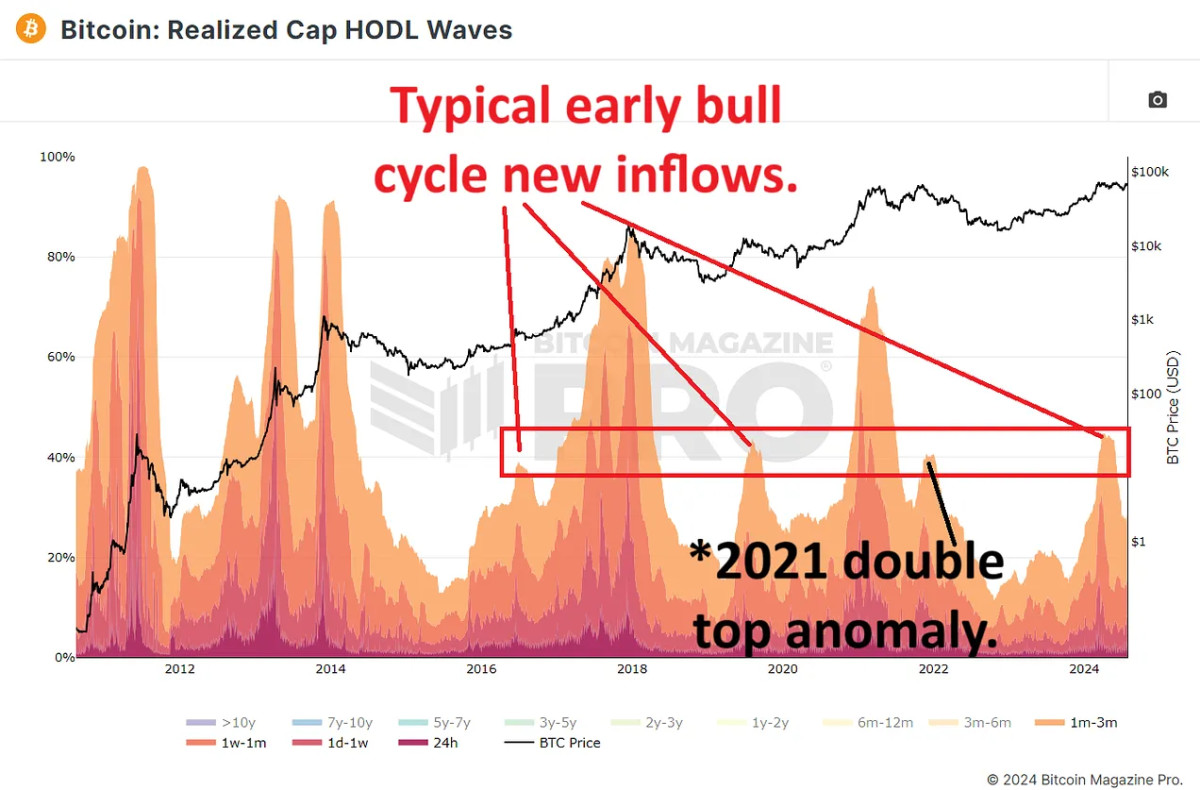

The Bitcoin HODL wave and the realized capped HODL wave reveal this shift. These indicators group Bitcoin community customers primarily based on how lengthy they’ve held their cash and present their influence on the cumulative worth of Bitcoin. Latest information reveals that roughly 20% of Bitcoins are held for 3 months or much less, suggesting that new customers are getting into the market, however as might be seen from the typical lively addresses within the above information, Bitcoin shouldn’t be used as regularly. As excessive as earlier than.

The influence of those new customers on the realized cap (Common cumulative worth of all BTC) is sort of massive, with greater than 40% of latest affect coming from customers who’ve held Bitcoin for 3 months or much less (The hotter crimson/orange colour within the picture under signifies). This implies that customers are getting into the market at larger costs and behaving in a fashion per earlier cycles (We’ve got just lately seen preliminary early bull cycle inflows corresponding to earlier cycles, as proven within the crimson field), simply not as typically as we have seen earlier than.

Understanding market forces and retail participation

A take a look at previous Bitcoin cycles reveals that surges in retail exercise typically precede market peaks. For instance, within the bull markets of 2017 and 2021, retail curiosity surged about 6 months earlier than the value peaked. As evidenced by Google Traits, there’s at present no important enhance in retail curiosity, suggesting that we’re experiencing extra cautious and sustainable market progress.

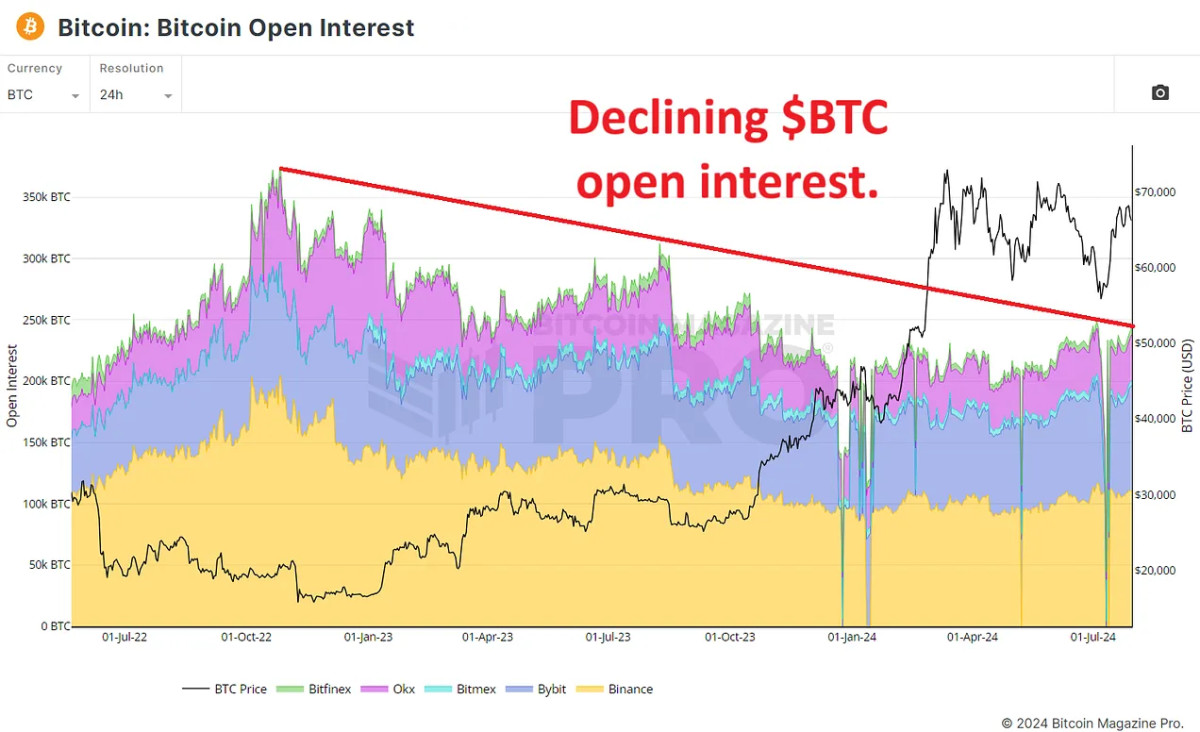

One other key consideration is the Bitcoin Open Curiosity chart, which measures the full worth of open Bitcoin futures contracts. This metric has not grown considerably since late 2022; in actual fact, we now have seen a gentle decline because the bear market cycle lows (As proven by the descending crimson line within the determine under). This implies that traders at the moment are extra prepared to commerce precise Bitcoin fairly than simply take part in derivatives trades. This implies that traders are extra inquisitive about holding Bitcoin for the long run fairly than chasing short-term speculative positive aspects.

in conclusion

Given present traits, the dearth of retail frenzy could also be seen as a constructive signal for the market’s long-term outlook. As Bitcoin approaches new document highs, it is essential to maintain a detailed eye on retail traders. If retail traders begin to enter the market in massive numbers, will they fall into their outdated habits of pure “FOMO” shopping for, or will they proceed to favor long-term holding?

In brief, regardless of the decline in Bitcoin’s lively person metrics, the market is displaying indicators of stability and long-term funding. The dearth of direct curiosity from retail traders might look bearish, however it’s extra prone to be bullish, because it suggests a extra cautious and sustainable progress trajectory.

For a extra in-depth take a look at this matter, take a look at a latest YouTube video right here: