Solana (SOL) has been on a rollercoaster experience of late, with erratic adjustments in worth and even pullbacks in lots of circumstances.

Associated Studying

The market’s wild swings current a tough image for Solana; nonetheless, specialists stay optimistic. Even within the face of downward stress, they consider that is only a passing section. The technological growth of altcoins portends an attention-grabbing future.

As of this writing, SOL is buying and selling at $150, down 6.2% on the each day and 17.1% on the week, in response to Coingecko.

Even amid market turbulence, buying and selling quantity reached $9.8 billion up to now 24 hours, demonstrating the extent of buying and selling exercise and investor curiosity.

Technical Indicators and Bullish Patterns

Famend cryptocurrency analyst Ali Martinez lately spoke concerning the potential return of Solana, which has merchants and consumers very .

Martinez’s analysis suggests {that a} bullish megaphone sample is forming on Solana’s 4-hour chart. This development of accelerating volatility usually precedes vital value will increase.

I do know, the autumn continues to fall!

Nonetheless, #solana A bullish bullish megaphone could also be forming on the 4-hour chart. The current correction to the 61.8% Fibonacci stage and the oversold RSI recommend now could also be an excellent time to purchase $SOL.

Contemplate setting a cease round $156-154 after which… pic.twitter.com/ylnaPAf2EV

— Ali (@ali_charts) August 1, 2024

One of many foremost indicators validating Solana’s optimistic outlook is the digital asset’s adjustment to the 61.8% Fibonacci retracement stage. Fibonacci retracements are crucial in technical evaluation and assist estimate potential assist and resistance ranges. Particularly when regular market fluctuations are anticipated, the above ranges are seen as a turning level.

To cut back threat, Martinez recommends inserting a stop-loss order between $156 and $154, thus guaranteeing that if the worth falls to that predetermined stage, the holding shall be liquidated instantly. This method is designed to reduce potential losses and permit buyers to revenue from anticipated development traits.

As a substitute, Martinez has a take-profit goal of $200 to $259, thus offering a wholesome revenue margin for these ready to barter present market dynamics with measurable threat.

Lengthy-term prospects and strategic positioning

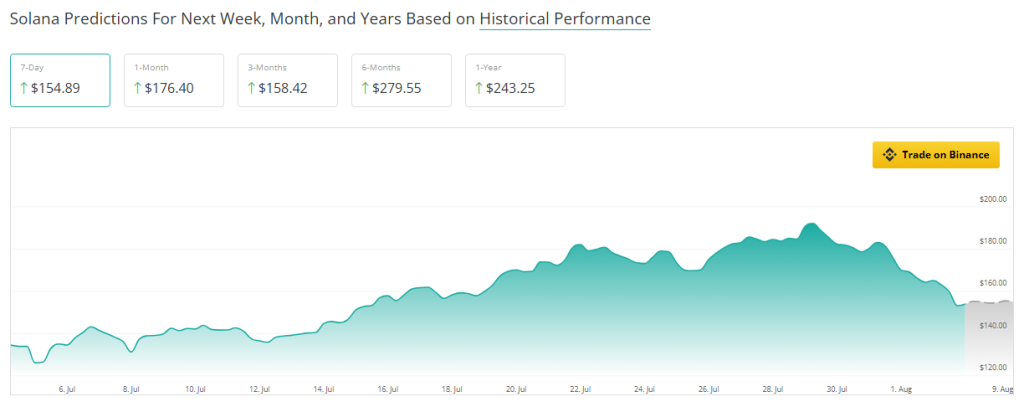

Regardless of the inherently unstable nature of the cryptocurrency market, Solana’s long-term prospects are very vivid. In response to knowledge from cryptocurrency forecasting device CoinCheckup, SOL is promoting at a value that’s 14.59% decrease than subsequent month’s anticipated value. This underperformance suggests valuations could also be undervalued, offering a window of alternative for buyers getting ready for a comeback.

In response to CoinCheckup, the worth will improve by 2.91% within the subsequent three months. That is the start of the therapeutic time. Whereas the anticipated development is small, it units the stage for better development.

Associated Studying

Issues are wanting up for Solana: Forecast knowledge exhibits it’s anticipated to rise 80% over the subsequent six months. This prediction could also be based mostly on the concept that the Web will enhance, extra individuals will use it, and the market will develop.

Featured pictures from Chainaanalysis, charts from TradingView