Bitcoin appears unable to maneuver away from the $60,000 worth degree because it continues to commerce amid uncertainty. On Saturday, August 3, the cryptocurrency fell sharply once more, briefly falling under the $60,000 mark.

Though this drop solely lasted a couple of minutes, it was fairly important, particularly contemplating that Bitcoin was buying and selling above $62,000 earlier within the day. This volatility had a big affect on market members, ensuing within the liquidation of numerous lengthy positions.

Associated Studying

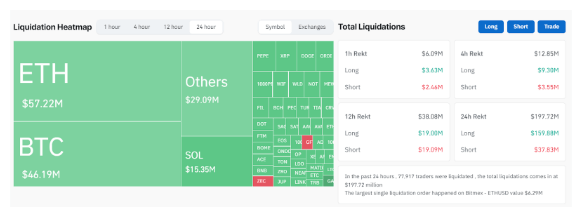

As of this writing, over $197 million price of leveraged positions have been liquidated previously 24 hours. It’s price noting that this determine surge to On the peak of the promoting strain, it reached as excessive as $288 million.

Bitcoin and market clearing

Bitcoin’s continued lack of ability to take care of a steady place above $60,000 highlights the unsure and speculative nature of the cryptocurrency market. Merchants and buyers stay cautious and intently monitor its worth actions.

Current experiences might have fueled this warning Initiated compensation Bankrupt cryptocurrency lender Genesis World Capital flooded the market with extra digital property, primarily Bitcoin and Ethereum.

This cautious strategy has inadvertently contributed to the lingering bearish sentiment surrounding different cryptocurrencies, given the dominance of Bitcoin and Ethereum out there. Though Bitcoin and Ethereum had the very best liquidated positions, the affect has unfold to different digital property.

In line with Coinglass knowledge proven under, Ethereum leads the market with $57.22 million price of leveraged place liquidations. Bitcoin adopted with $46.19 million in liquidations and Solana with $15.35 million in liquidations.

The entire liquidation quantity reached $197.72 million, nearly all of which ($159.88 million) was lengthy positions. Many of the liquidations occurred in Binance, OKX and Bybit, with $85.88 million, $65.83 million and $16.47 million respectively, and their respective lengthy liquidation charges had been 80%.

Usually bearish

The crypto trade isn’t any stranger to piecemeal liquidation Such an enormous quantity. Given the prevailing short-term bearish sentiment, a lot of the liquidation has been in lengthy positions. June 24, market nearly witnessed Positions price $300 million had been liquidated inside 24 hours. Likewise, on June 7, when Bitcoin costs plummeted from $71,000 to $68,000, greater than $360 million price of positions had been liquidated.

Associated Studying

Current market dynamics counsel the trade will not be out of the woods but from such a reckoning. Bitcoin continues to wrestle to remain above $60,000, a pattern that’s prone to proceed within the coming weeks. A part of the reason being that the spot Bitcoin ETF, which has traditionally been a catalyst for Bitcoin worth surges, closed within the damaging final week. Particularly, there have been $237.4 million in outflows on the finish of Friday’s buying and selling session, Most single-day outflow Efficient from Could 1st.

Featured photos are from The Michigan Day by day, charts are from TradingView