Sri Lanka isn’t precisely identified for its startup ecosystem, however one firm has turn out to be one thing of an outlier on the South Asian island nation over the previous 20 years. WSO2, an open supply enterprise software program supplier whose shoppers embrace Samsung, Axa and AT&T, lately agreed to be acquired by non-public fairness large EQT, with a valuation of greater than $600 million reported by TechCrunch on the time. (We are able to now verify that the valuation is definitely precisely $600 million.)

The deal, which is topic to regulatory approval, means EQT will turn out to be the only proprietor of WSO2, buying all excellent shares, together with shares from WSO2 buyers and present and former WSO2 staff.

Provided that 30% of proceeds will go to those staff, this liquidity occasion might additionally create important wealth for these inclined to begin their very own companies.

“It reveals that fairness is necessary — one of many issues we’ve insisted on from day one is that each worker is a shareholder,” Weerawarana informed TechCrunch. “This is essential, and it is a idea that hasn’t been understood earlier than as a result of no firm has exited and supplied any significant monetary return. Seeing is believing, proper? Discuss is reasonable.

Thriving in warfare and turmoil

WSO2 was based in 2005 in Colombo, the capital of Sri Lanka. It’s a middleware stack that constitutes instruments equivalent to API administration, just like Apigee acquired by Google for US$625 million; Identification and Entry Administration (IAM), just like the US$15 billion public Buying and selling Okta.

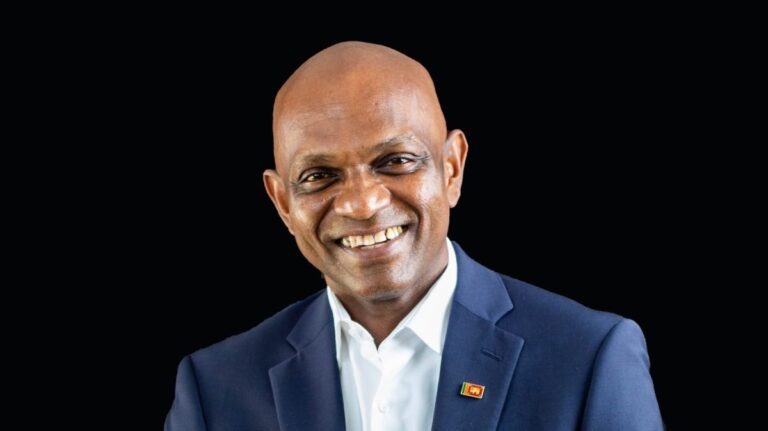

The primary driving drive behind that is Weerawarana, a pc scientist and a key determine within the open supply group for the previous 25 years, each as a member of the Apache Software program Basis and, most lately, because the creator of Ballerina, a cloud-native basic for integrating decentralized techniques. particular programming language.

Previous to becoming a member of WSO2, Weerawarana labored on the IBM R&D group in the US, aiding within the growth of Net providers specs equivalent to WSDL and BPEL. That’s the place the seeds for WSO2 had been sown.

“I truly tried to construct a brand new middleware stack inside IBM, however IBM wasn’t ,” Weerawarana stated. “So the one choices had been to both begin an organization or abandon the thought.”

Weerawarana based WSO2 in August 2005 with two co-founders: Davanum Srinivas, who left two years later; and Weerawarana’s former IBM colleague Paul Fremantle, who would keep on as CTO till resigning in 2015 (he later rejoined, then Left once more, however nonetheless serves as a advisor).

Remarkably, WSO2’s middle of gravity stays in Sri Lanka, regardless of an extended civil warfare and exterior strain to relocate to the US (Weerawarana lived in the US for 16 years).

“I come again [to Sri Lanka] In 2001, two weeks earlier than I arrived in Colombo, the airport was attacked by a terrorist group – there are nonetheless items of the airplane on the bottom,” he stated. “In 2005, the warfare was nonetheless happening. Sri Lanka as a rustic failed to take care of a sustained surroundings of calm for us, however that didn’t matter.

Immediately, 80% of WSO2’s 780 staff are primarily based in Sri Lanka, with the rest unfold throughout a number of facilities in the US, Europe and Asia.

“I needed to show that we might construct a product-driven know-how firm in Sri Lanka,” Weerawarana continued. “There had by no means been an organization like this, there wasn’t even an organization prefer it in India at the moment. Indian firms had been very service-oriented and so had been Sri Lankan firms. However one of many greatest worth factors [for staying in Sri Lanka] In virtually each funding spherical, most buyers ask me once I’m going to maneuver again [to the U.S.]. My reply is all the time the identical: ‘I will not return.'”

Traders weren’t the one ones forcing WSO2 to relocate: clients and opponents additionally used its location to oppose it at varied factors.

“A few of our opponents combat us and say, ‘Have you learnt the place they’re?’ and that turns into a problem,” Weerawarana stated. “Then we have now clients saying, ‘You are positioned so far-off, why are you charging us these costs?'”

WSO2’s geography, however, permits it to pick out technical expertise, primarily as a result of it’s a product-based enterprise in a sea of providers.

“Now we have by no means had an issue with engineering and technical expertise. Over the previous 19 years, we have now been in a position to rent the perfect expertise in Sri Lanka. “In case you are a inventive engineer, would you quite work in a providers firm or be a inventive engineer? And a place devoted to cutting-edge know-how? “

Intel processor

After WSO2 raised a small spherical of angel funding in 2005, Intel’s enterprise capital arm turned its earliest backer, investing in 2006 and making a number of follow-on rounds in subsequent years.

Intel Capital’s preliminary money infusion of $2 million was crucial to WSO2’s early growth and was the results of fortuitous timing. Pradeep Tagare was a senior funding supervisor at Intel Capital on the time and met Weerawarana via his work with the Apache Software program Basis. Tagare is trying to spend money on an open supply startup to enhance two different open supply investments it has made – one in Java-centric software server firm JBoss (which Purple Hat later acquired for $350 million) , one other funding in database firm MySQL (which Solar later acquired for $1 billion).

“We’re taking a look at a collection of open supply investments as a strategic transfer by Intel, primarily to construct various stacks on Intel {hardware},” Tagare defined to TechCrunch. “We invested in JBoss and we invested in MySQL. So, we are actually on the lookout for an open supply middleware firm, and WSO2 suits our necessities.

Tagare’s argument is that Asian nations won’t solely profit from the open supply motion, however might also have a lot to contribute. Open supply software program growth was naturally decentralized, opening up the coding and collaboration course of to individuals who had not labored at a big tech firm on the time.

“Now they will contribute — earlier than, it was actually all managed by Microsoft and the oracles of the world,” Tagare stated. “Its location shouldn’t be essentially required, however being in Asia makes WSO2 much more attention-grabbing.”

A lot has modified within the 20 years since WSO2 emerged. With the arrival of cloud computing and microservices (software program constructed from smaller, loosely related elements that may be developed and maintained independently, and might simply depend on APIs), WSO2 has developed as enterprises transition away from conventional monolithic functions. Be in place.

Now, with the AI revolution in full swing, WSO2 will reap the benefits of APIs and IAM as they’re key elements of the AI stack, from integration to authentication and extra. As well as, WSO2 is integrating synthetic intelligence into its personal merchandise, lately launching a brand new API supervisor that enables builders to combine synthetic intelligence-powered chatbots into their APIs, permitting non-coders to make use of pure language Take a look at API.

WSO2 has raised $133 million through the years, in keeping with Crunchbase. Nonetheless, Weerawarana clarified that solely US$70 million is main capital. Different rounds, equivalent to a $93 million Collection E two years in the past led by Goldman Sachs, had been made up of fairness and debt.

Irrespective of how the funds are divided, the truth that can’t be ignored is that WSO2 was already a brand new startup when EQT came visiting. In spite of everything, most profitable venture-backed firms exit inside 10 years.

So what’s given?

“There have been lots of people who needed to purchase our firm through the years, however I turned them down as a result of I all the time needed to construct an organization that would IPO — principally a standalone enterprise,” Weerawarana stated.

That each one modified in Might, when WSO2 accepted a suggestion from EQT Non-public Capital Asia (previously Baring Non-public Fairness Asia), a non-public fairness agency that acquired the corporate in 2022 for greater than $7 billion. The distinction this time is straightforward: Weerawarana stated one among WSO2’s controlling shareholders “needed entry to liquidity.”

“As a result of they personal greater than 50 %, it turns into a management transaction,” he stated.

The shareholder is San Francisco-based Toba Capital, a enterprise capital agency based by Vinny Smith after he offered Quest Software program to Dell in 2012 for greater than $2 billion. Quest had beforehand invested in WSO2 and transferred its fairness to Dell via the acquisition, however Toba purchased the inventory again from Dell and continued to make additional investments in WSO2, together with the acquisition of Intel Capital. Toba Capital accomplice Tyler Jewell additionally succeeded Weerawarana as CEO for a two-year time period, with Weerawarana returning to the recent seat in 2020.

Weerawarana stated the corporate has been money stream optimistic since 2017 and has been worthwhile “since round 2018,” nevertheless it doesn’t have important capital to contemplate a “multi-year technique.” That is one thing EQT Group (EQT), one of many world’s largest non-public fairness companies, can do.

In actual fact, WSO2 stated it should hit $100 million in annual recurring income (ARR) by the third quarter of this 12 months, which was one of many key causes for EQT’s go to.

“WSO2 actually has all of the substances we’re on the lookout for in a software program enterprise,” Hari Gopalakrishnan, accomplice and co-head of world providers at EQT, informed TechCrunch. “Deep and enduring enterprise buyer relationships, profitable product-led progress, technically sturdy merchandise, and prudent monetary administration. Choose an edge, WSO2 could have it.

From the skin, a sale to personal fairness could not seem to be a great final result for an formidable founder who values the corporate’s independence. However Weerawarana insists the outcomes will higher assist WSO2 do exactly that.

“I began the corporate to make one thing lasting. One of many causes we did not promote it earlier than was that we knew this may all finish,” he stated. “EQT doesn’t have another enterprise on this house and they’re attempting to construct it round WSO2 quite than merging it with different companies. Their aim is to construct the corporate in 5 years, which is consistent with my aspirations and gave us 5 years Conduct an preliminary public providing.

driving drive

Whereas operating WSO2 itself is a time-consuming endeavor, Weerawarana has been busy with different initiatives equivalent to his philanthropic enterprise referred to as Avinya Basis, which he arrange in 2022 to offer financially deprived people via vocational training programmes. Offering assist to deprived kids.

In 2017, Weerawarana additionally began driving for Uber, a transfer he stated was an effort to make such work extra acceptable to Sri Lankan society. If a profitable businessman like him can do it, anybody can.

“I’d come residence from get off work and choose somebody up,” he stated. “The primary level I am attempting to get throughout is that individuals who drive are not any totally different than individuals who work in different jobs – they simply present a service and also you pay for it. Now we have a mentality right here that working in sure varieties of jobs of individuals are totally different from different varieties of individuals. It’s necessary to interrupt that down – and Uber driving is a part of that. The Avenia Basis additionally appears at this difficulty and works to assist all of our expert staff, equivalent to tradespeople.

The pandemic, together with different world occasions, has put Weerawarana’s Uber driving on maintain quickly; as a result of individuals do it to outlive and he does not need to take cash from individuals who want it.

“I’d do it once more – issues are getting higher,” he stated. “Tourism is sort of again to regular, so the demand can be there and it’d make sense for me to drive. However I do not need to take away different individuals’s enterprise.