Fantom Blockchain’s efficiency within the second quarter (Q2) of the 12 months was combined, with key monetary metrics cooling off the broader cryptocurrency market downturn In response to the newest report from knowledge intelligence firm Messari, the Fantom Basis has introduced a rebranding to Sonic Labs.

FTM Market Cap, Income and Token Economics

After a stellar first season, Fantom’s circulation Market worth It dropped 41% sequentially from US$2.8 billion to US$1.7 billion. Nevertheless, the token’s market capitalization remains to be up 94% year-over-year in comparison with the second quarter of 2023.

Associated studying

Income, which measures the fuel charges charged by the community, fell 42% from the earlier quarter, from 1.8 million FTM to 1.0 million FTM. In U.S. greenback phrases, income fell 38% quarter-over-quarter, from $1.2 million to $800,000.

This decline follows a peak in Q3 2023 as a consequence of exercise surrounding non-fungible tokens (NFT) Inscription, however in response to Messari believes that income is predicted to rebound as on-chain exercise will increase within the broader cryptocurrency area.

The report additionally highlighted modifications in Fantom’s token economics throughout the second quarter. Ecosystem Vault and Gasoline Monetization are scheduled to launch within the fourth quarter of 2022, decreasing Transaction charges from 30% to five% and reallocate the remaining 25%.

As of the tip of the second quarter, the circulation of the protocol’s native token FTM reached 2.8 billion, with an annualized inflation fee of three% and a quarterly improve of 25%.

Exercise on the Fantom chain slows down

Fantom’s on-chain exercise additionally confirmed a downward pattern within the second quarter. Common every day transaction quantity exceeded 223,000 transactions, down 10% from 247,000 transactions within the earlier quarter. every day Occasion tackle It fell 21% quarter-on-quarter to 31,900, however the report famous that this pattern reversed on the finish of the quarter.

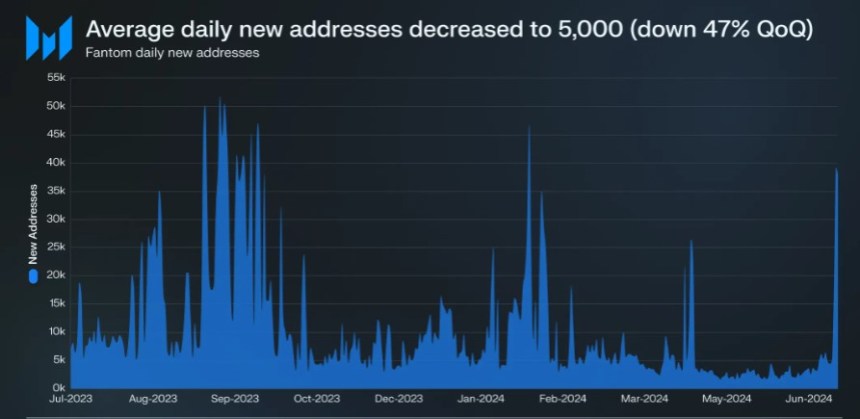

New tackle progress additionally slowed, falling 47% quarter-to-quarter to a median of 5,000 per day. Nevertheless, the report highlights some optimistic developments, together with a rise within the variety of energetic validators on the community.

Associated studying

After the governance proposal lowered the staking requirement from 500,000 FTM to 50,000 FTM, the variety of energetic validators elevated by 6% month-on-month to 58, with 14 self-staking lower than 500,000 FTM.

Staking FTM additionally see influx For the second consecutive quarter, it grew 5% from the earlier quarter to 1.3 billion tokens. Nevertheless, as a result of depreciation of token costs, the full worth of pledged FTM fell 39% from the earlier quarter to $780.4 million.

Fantom’s whole locked worth (TVL) in decentralized finance (DeFi) functions fell 28% month-on-month to $91.2 million, rating forty second amongst blockchain networks. Nevertheless, TVL denominated in FTM elevated by 22% month-on-month, indicating that capital remains to be flowing in regardless of the token worth falling.

On the time of writing, FTM is buying and selling at $0.3345, up simply 1% up to now 24 hours. On the month-to-month timeframe, the coin is down 27% over the previous month because the broader market declines.

Featured picture from Shutterstock, chart from TradingView.com