The value of Bitcoin and the market as a complete began the week with one among its largest declines since 2024. Alternative accumulation funds present extra digital belongings at low costs.

In accordance with the most recent on-chain information, a considerable amount of Bitcoin has been moved out of cryptocurrency exchanges. The query right here is – what does this imply and the way does it have an effect on BTC value?

Do traders help the bull market persevering with?

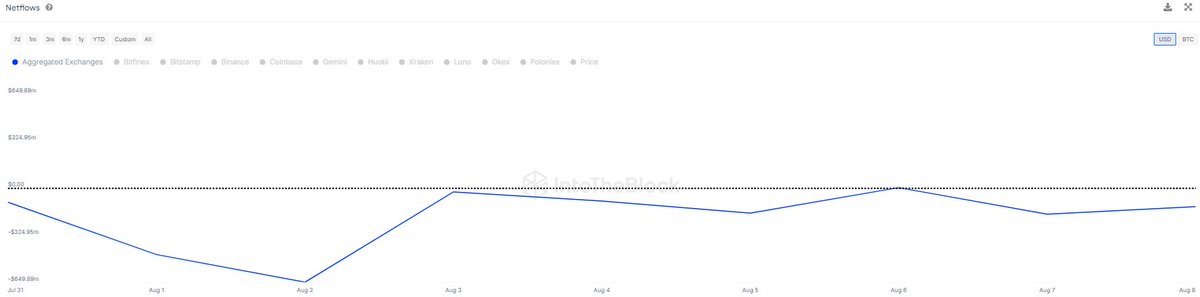

In accordance with the most recent information from IntoTheBlock, greater than 28,000 BTC (price greater than $1.7 billion) have been transferred out of cryptocurrency exchanges previously week. The on-chain disclosure is predicated on modifications within the Netflows metric, which displays the quantity of particular cryptocurrencies shifting out and in of centralized exchanges.

A rise within the Web Circulation worth (or when it’s optimistic) signifies that more cash is coming into a cryptocurrency alternate than leaving it. However, when the worth of this indicator is decrease than this worth, it implies that extra cryptoassets are flowing out of the buying and selling platform than flowing into it.

Supply: IntoTheBlock

As proven within the chart above, Bitcoin’s web movement metric has been declining over the previous few days, which means massive traders have been shifting belongings away from centralized exchanges. In accordance with information from IntoTheBlock, the $1.7 billion in BTC withdrawn previously seven days is the most important outflow seen in that point interval to date in 2024.

Whereas it’s tough to inform the rationale behind such a large exodus, such large-scale motion of cryptocurrencies away from centralized exchanges often indicators a shift in investor sentiment. This exhibits that enormous traders have modified their holding methods and even made new accumulations, exhibiting their confidence within the long-term prospects of Bitcoin.

Moreover, the lowered availability of main cryptocurrencies on buying and selling platforms may result in a provide crunch. In the end, a decline in Bitcoin’s international alternate reserves may set off a surge in Bitcoin costs.

Bitcoin Worth at a Look

Following a pointy decline from above $64,000 to $48,000 on Monday, August 5, Bitcoin value has proven super resilience over the previous week, regaining above $62,000.

As of this writing, the principle cryptocurrency is buying and selling round $60,400, with costs down 1% previously 24 hours. On the identical time, information from CoinGecko exhibits that BTC continues to be down greater than 3% this week.

The value of Bitcoin hovering across the $60,000 mark on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView