Douglas Rising/iStock by way of Getty Photographs

Industrial Choose Sector SPDR Fund ETF (XLI) Features +1.26% The SPDR S&P 500 Belief ETF (SPY) edged forward within the week ended August 9 +0.02%.

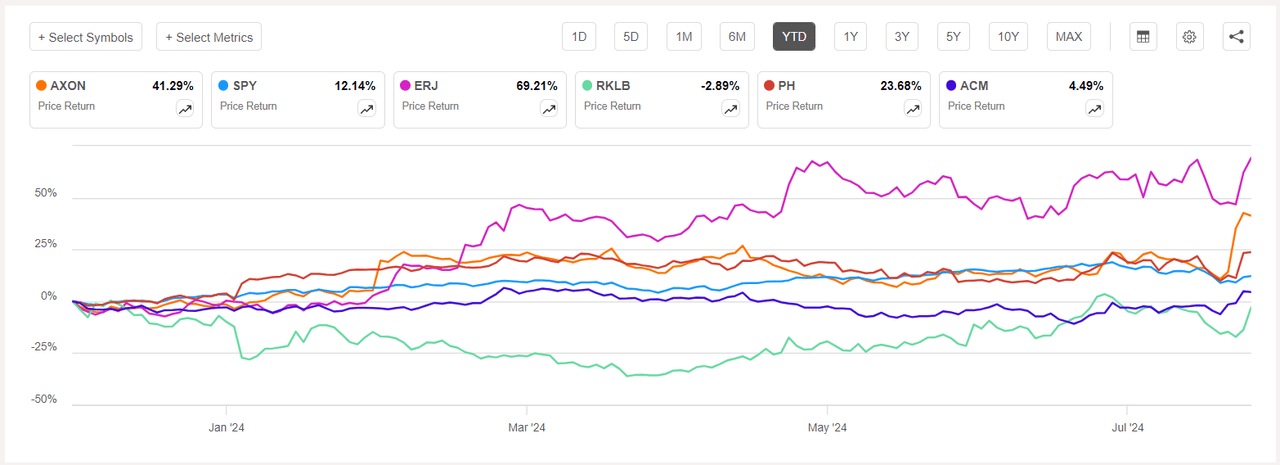

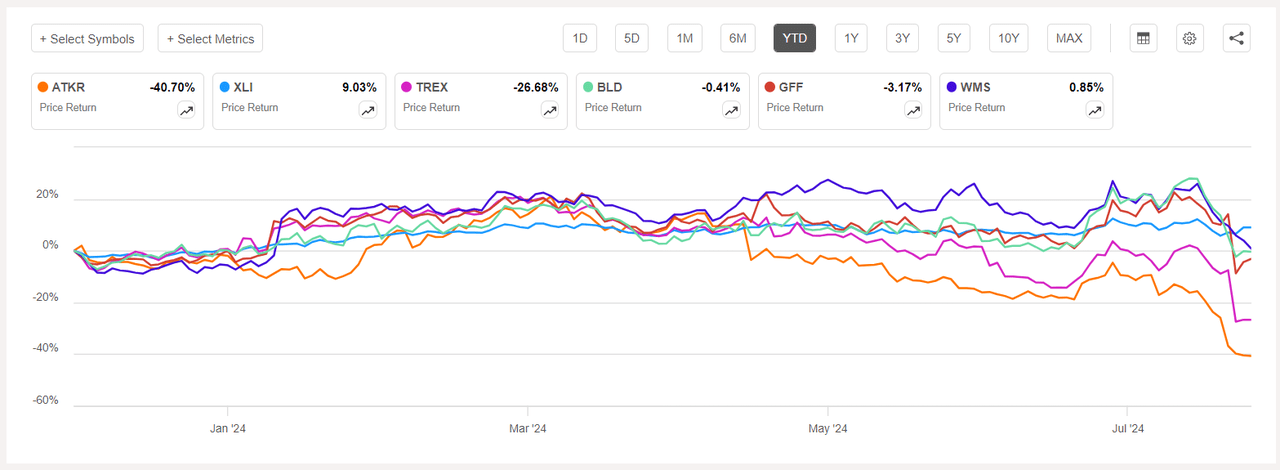

Earnings are at work once more, serving to Axon rank among the many high industrial development shares (in talked about beneath), whereas Atkore’s share worth plummeted, changing into the highest loser. Yr so far, XLI has climbed +9.03%whereas SPY has risen +12.14%.

The highest 5 gainers within the industrial sector (shares with a market capitalization of greater than $2B) all rose by greater than +9% Every this week. Yr so far, 4 of those 5 shares are within the inexperienced.

Axon Enterprises (NASDAQ:AXON) +24.85%. Shares of Taser tools maker soar +18.39% On Wednesday, second-quarter outcomes (after the bell on Tuesday) beat expectations, and full-year income got here in above forecasts. YTD, +41.29%.

AXON has a SA Quantitative Score of Maintain, which takes into consideration components corresponding to momentum, profitability and valuation. The inventory has a profitability issue grade of B+ and a development issue grade of A. The common score from Wall Road analysts varies with a Purchase score, with 8 out of 15 analysts labeling the inventory a Robust Purchase.

Embraer (ERJ) +13.20%. Brazilian plane maker shares soar +10.49% after reporting second-quarter outcomes on Thursday. YTD, +69.21%.

ERJ’s SA Quantitative Score is Robust Purchase, with a Valuation Rating of C+ and a Momentum Rating of A+. The common score from Wall Road analysts can be optimistic, with a Purchase score, with 6 out of 15 analysts contemplating the inventory a Robust Purchase.

The chart beneath reveals the highest 5 gainers and SPY’s year-to-date worth return efficiency:

Rocket Lab (RKLB) +11.64%. Inventory worth soared +12.58% The aerospace firm reported document quarterly income on Friday, pushed by sturdy demand for its launch companies and house programs merchandise. YTD, -2.89%. RKLB has a SA Quantitative score of Maintain, which contrasts with the common Purchase score from Wall Road analysts.

Parker Hannifin(PH) +9.89%. Shares of the Cleveland-based firm, which makes movement and management expertise and programs, rose +10.84% On Thursday, outcomes for its fiscal fourth quarter ended June 30 beat expectations. YTD, +23.68%. SA has a Purchase score on PH, with the common Wall Road analyst score in step with their very own Purchase score.

AECOM (ACM) +9.50%. Infrastructure consulting companies supplier shares rise +5.06% That comes after quarterly outcomes have been launched on Tuesday (after the bell on Monday), by which non-GAAP earnings per share and income topped expectations. The inventory worth additionally rose sharply +5.83% Thursday. YTD, +4.49%. ACM’s SA Quantitative Score is a Maintain, which contrasts with the common Robust Purchase score from Wall Road analysts.

The 5 greatest losers this week in industrial shares (market caps over $2B) all fell by greater than -12% Every. Yr so far, 4 of those 5 shares are within the pink.

Atkore (NYSE: ATKR) -22.34%. Shares of the Harvey, Unwell.-based firm, which makes electrical, mechanical, security and infrastructure merchandise, fell -14.70% On Tuesday, outcomes for the fiscal third quarter ended June 28 fell in need of expectations. YTD, -40.70%.

ATKR’s SA Quantitative Score is Promote, and its Progress and Momentum issue grades are each D-. The common Wall Road analyst score disagrees, with a Purchase score, with three out of six calling the inventory a Robust Purchase.

TREX -21.43%. inventory worth falls -21.54% On Wednesday, the corporate reported combined second-quarter outcomes (after the bell on Tuesday) and lowered its full-year 2024 income steering. YTD, -26.68%. TREX has a SA Quantitative Score of Maintain, a Profitability Rating of A-, and a Valuation Rating of C-. Wall Road analysts have a combined common score, with a Purchase score, with 7 out of 19 analysts labeling the inventory a Robust Purchase.

The chart beneath reveals the year-to-date worth return efficiency of the 5 worst losers this week and XLI:

High Construct (BLD) -14.47%. inventory worth falls -7.12% On Tuesday, second-quarter outcomes fell in need of expectations. The inventory additionally took successful on Wednesday, falling -7.47%. Yr so far, -0.41%. BLD’s SA Quantitative Score is Purchase, and the common score from Wall Road analysts can be a Purchase.

Griffon (GFF) Shares of the maker of shopper, residence and constructing merchandise fall -7.47% On Wednesday, quarterly outcomes missed expectations. YTD, -3.17%. SA has a quantitative score of Maintain on GFF, which contrasts with the common Robust Purchase score from Wall Road analysts.

Superior Drainage System (WMS) -12.20%. The corporate’s shares fell all week, and the water administration merchandise maker’s quarterly outcomes got here in beneath expectations. YTD, +0.85%. WMS’s SA Quant score is “Maintain,” whereas the common score from Wall Road analysts is “Robust Purchase.”