Knowledge reveals that buying and selling inflows to Tether (USDT) and USD Coin (USDC) have surged lately. This is why this is likely to be related to Bitcoin.

Stablecoin inflows are at the moment increased than normal

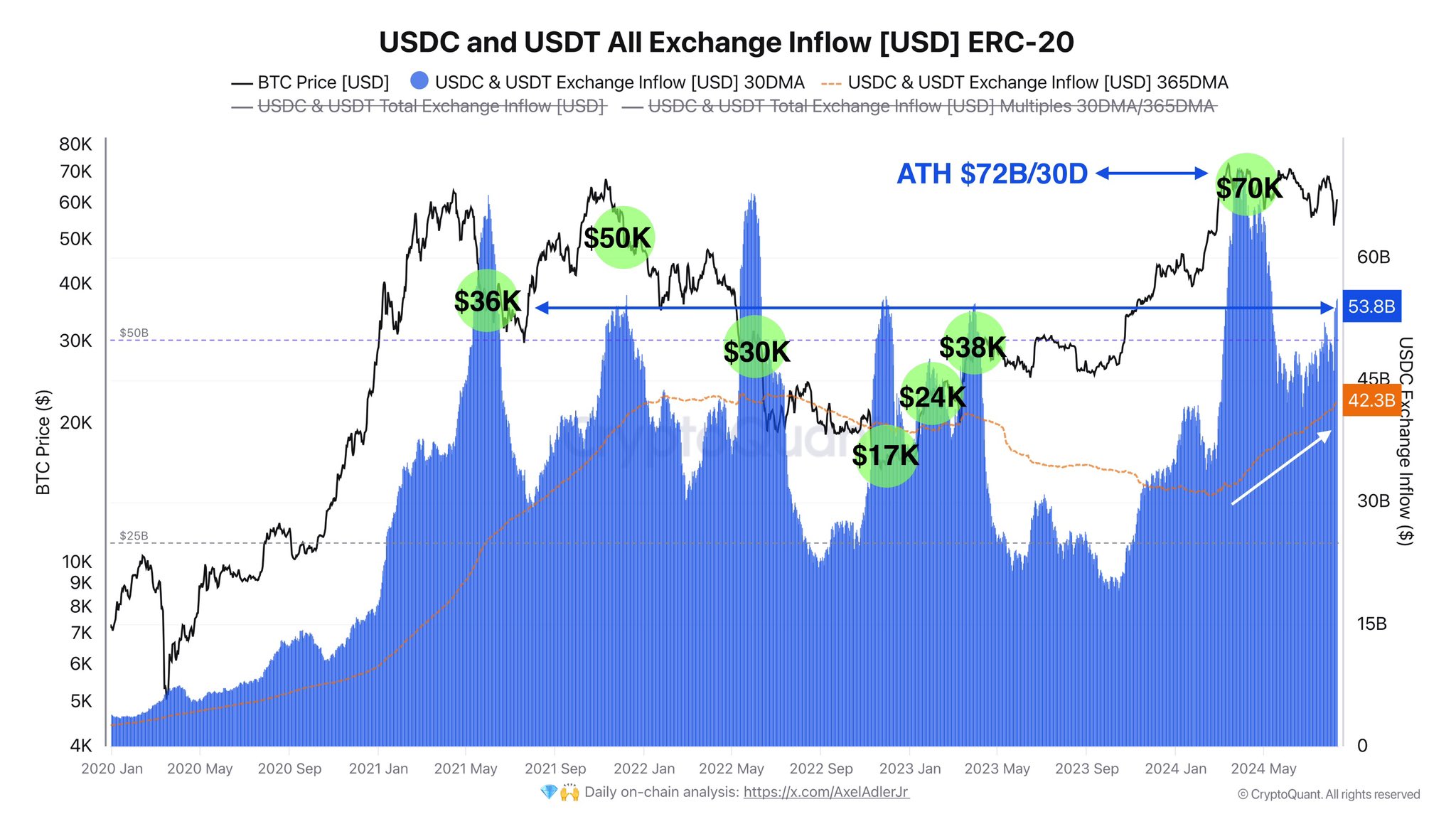

As CryptoQuant creator Axel Adler Jr explains in a brand new article on X, the highest two stablecoins USDT and USDC have seen a rise in common month-to-month inflows lately.

“Alternate influx” right here refers to an on-chain metric that tracks the entire quantity of a given asset deposited into wallets related to centralized exchanges.

When the worth of this indicator is excessive, it signifies that the change is at the moment receiving a lot of deposits. This development reveals that there’s demand amongst holders to commerce cryptocurrencies.

However, a decrease metric means traders might select to carry their cash since they don’t seem to be making massive transfers to exchanges.

What both development might imply for the market, although, will depend on the kind of underlying asset. Traders depositing cash right into a unstable asset like Bitcoin is usually a bearish sign for costs, as they might switch cash to promote.

Within the case of stablecoins comparable to USDT and USDC, whereas deposits may imply traders wish to promote these tokens, such gross sales is not going to have an effect on their costs as a result of they’re inherently value-stable. That stated, they do relate to the broader market.

Traders typically retailer funds in stablecoins to keep away from the volatility of Bitcoin and different currencies. Nonetheless, traders who park their cash like this typically plan to revisit the volatility facet.

Due to this fact, inflows of USDT and different stablecoins might imply that these traders on the sidelines are able to put money into BTC and the corporate. This swap would naturally have a bullish impression on the costs of those unstable tokens.

Under is a chart exhibiting the development of the 30-day and 365-day shifting averages (MA) of the mixture inflows of USDT and USDC over the previous few years:

The worth of the metric seems to have been heading up in latest days | Supply: @AxelAdlerJr on X

As proven within the chart above, throughout Bitcoin’s rise to new all-time highs (ATH), FX inflows to the 30-day shifting common USDT and USDC surged to fairly excessive ranges, indicating appreciable demand to purchase the asset.

Throughout this surge, the indicator hit a brand new file of each day deposits of $72 billion. Nonetheless, the indicator skilled appreciable cooling in the course of the subsequent financial downturn, nevertheless it has lately begun to rise once more.

Up to now, it has reached the $53.8 billion mark per day, which is sort of exceptional. If these new stablecoin deposits are certainly taking place to purchase into extra unstable currencies, Bitcoin and different currencies might see a bullish impact.

bitcoin worth

Bitcoin had retreated beneath $58,000 earlier within the day, however the asset seems to have recovered because it broke above $60,000 ranges.

Appears like the worth of the coin has total been shifting sideways over the previous couple of days | Supply: BTCUSD on TradingView

Featured photos from Dall-E, CryptoQuant.com, charts from TradingView.com