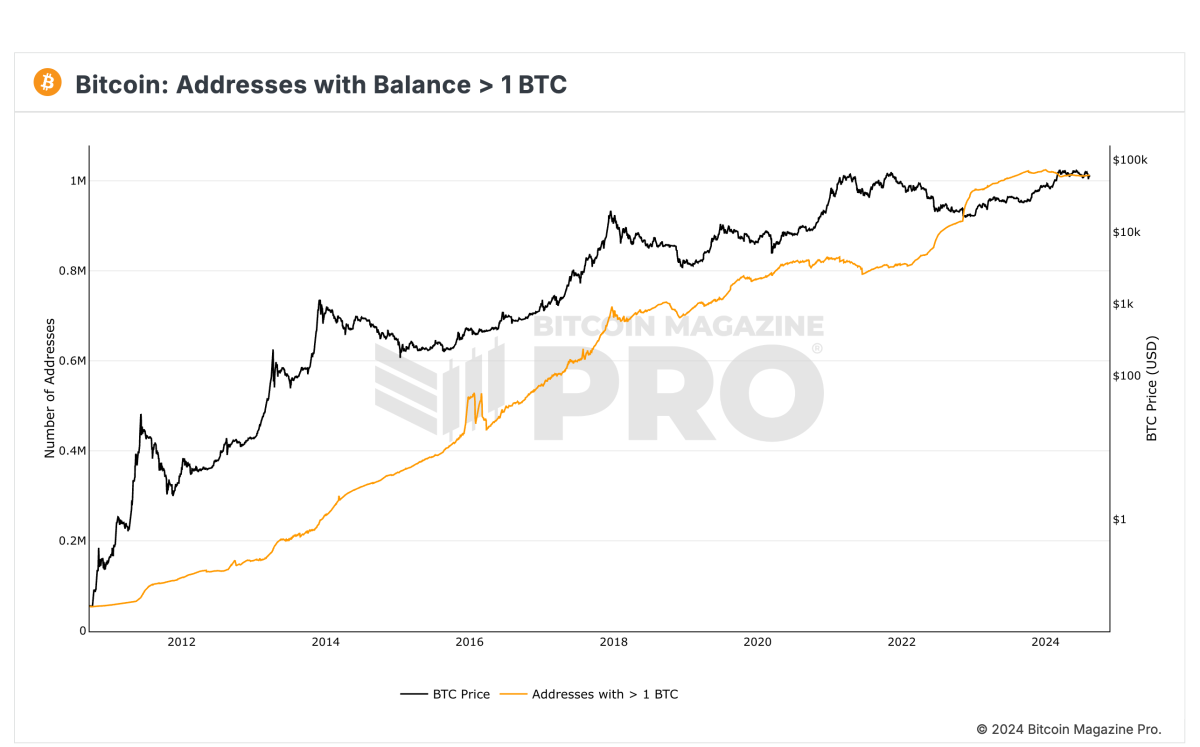

Based on Bitcoin Journal Professional, there are 1,012,650 Bitcoin addresses containing 1 BTC or extra.

Which means greater than 1 million BTC could possibly be taken off the market and held by robust palms, making up a big portion of the 21 million BTC sooner or later. Demand continues to rise as U.S. spot Bitcoin ETFs maintain a complete of over 901,000 BTC, whereas main company Bitcoin holder MicroStrategy holds 226,500 BTC. Moreover, MicroStrategy plans to boost $2 billion to purchase extra Bitcoin, additional underscoring the development of establishments shopping for and holding massive quantities of Bitcoin, tightening obtainable provide as demand will increase.

The variety of Bitcoin addresses holding 1 BTC or extra has traditionally lagged the worth of BTC. Nevertheless, over the previous two years, this development has reversed, with the variety of these addresses rising quicker than the worth of Bitcoin. The shift indicators rising adoption and displays rising long-term confidence in Bitcoin as extra customers accumulate and maintain massive quantities of Bitcoin.

The rise in addresses holding 1 BTC or extra signifies that each retail and institutional buyers are actively accumulating Bitcoin. With solely 21 million BTC being mined and round 19 million already in circulation, demand for Bitcoin seems to be rising as customers look to assert their share of the restricted provide.

For extra particulars, insights, and to enroll in entry to Bitcoin Journal Professional’s information and evaluation, go to the official web site right here.