An anticipated $2.5 billion inflow of stablecoins may drive Bitcoin costs considerably greater, 10x Analysis market researcher Markus Thielen detailed in a brand new report.

Bitcoin worth is about to rise

In his newest analysis word, Thielen defined the essential significance of monitoring and analyzing crypto capital flows, which gives vital insights into market situations that might speed up or dampen Bitcoin worth actions. “Merchants typically get caught off guard by worth drops and ignore the important thing indicators these flows present. Nonetheless, the other can also be true. A sustained improve in flows can push costs greater, however many additionally miss these indicators,” Thielen wrote .

Associated studying

The researchers clarify that monetary flows can predict worth actions in each instructions. In April 2024, costs corrected as “broad monetary flows primarily stopped.” Thielen added, “Because the market nears a backside, the resurgence of sure flows has helped push costs greater. The important thing issue is monitoring the sustainability of those flows, as with out continued help, rallies are likely to lose momentum. .

The report highlights the newest exercise from main stablecoin issuers. Thielen famous that final evening, Tether minted $1 billion in USDT, classifying it as stock building somewhat than fast market issuance. This distinction is essential as a result of it signifies steps being taken to arrange for potential future market motion, somewhat than an instantaneous injection of liquidity.

Moreover, the researchers detailed an vital remark from current issuances by Tether and Circle, which totaled practically $2.8 billion. Thielen interpreted this as a powerful signal of institutional buyers deploying new capital into the cryptocurrency market, which traditionally bodes nicely for Bitcoin. “If this pattern of issuance (not simply minting) continues, Bitcoin may rise additional,” Thielen commented.

Associated studying

Lookonchain, an on-chain evaluation platform, reported yesterday through

Moreover, Lookonchain could have discovered cause to situation a lot of new stablecoins. The corporate noticed giant quantities of USDT flowing to Cumberland. They stated: “In simply 8 days, Cumberland injected 1.04B USDT into the crypto market! An hour in the past, Cumberland as soon as once more obtained 141.5 million USDT from Tether Treasury and transferred it to main exchanges similar to Kraken, OKX, Binance, and Coinbase. Place.

Extra bullish catalysts

Cryptocurrency analyst Miles Deutscher gave another excuse to be bullish on Bitcoin through X . This part could also be over.

“This feels similar to August-October final 12 months. Retail curiosity is rapidly disappearing (YT views dropped sharply over the previous week). Present market gamers are apathetic. Lack of clear narrative (#Bitcoin worth motion appears to be like the identical) ),” Deutscher stated.

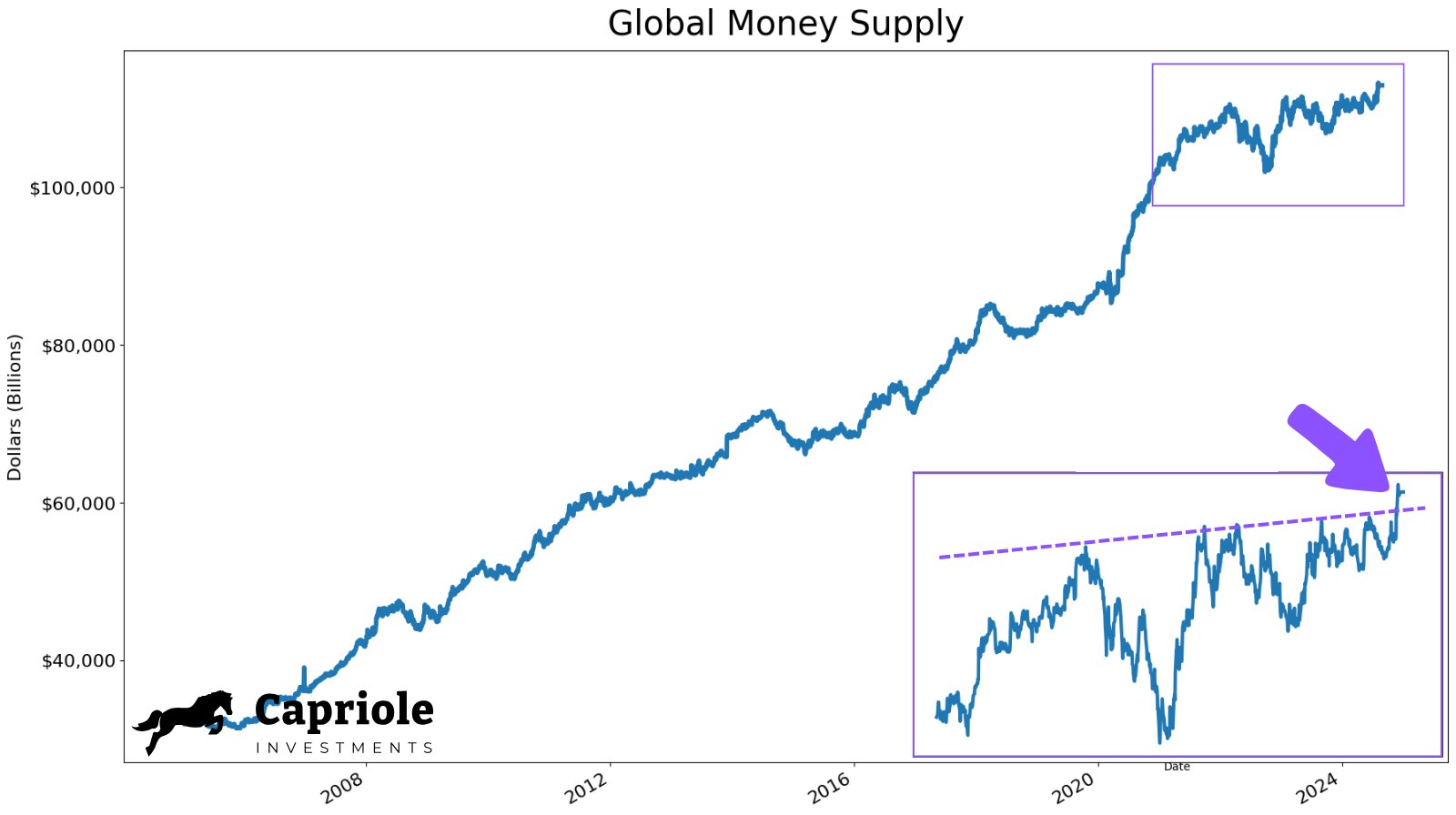

Charles Edwards, founding father of Capriole Investments, added a macroeconomic perspective, stating that the enlargement of the worldwide cash provide is the historic driver of Bitcoin worth will increase. “The worldwide cash provide is exploding. Plus, we’ve simply emerged from a large four-year consolidation. What do you assume this implies for Bitcoin? He provided an optimistic outlook based mostly on this issue.

At press time, BTC was buying and selling at $60,853.

Featured picture created utilizing DALL.E, chart from TradingView.com