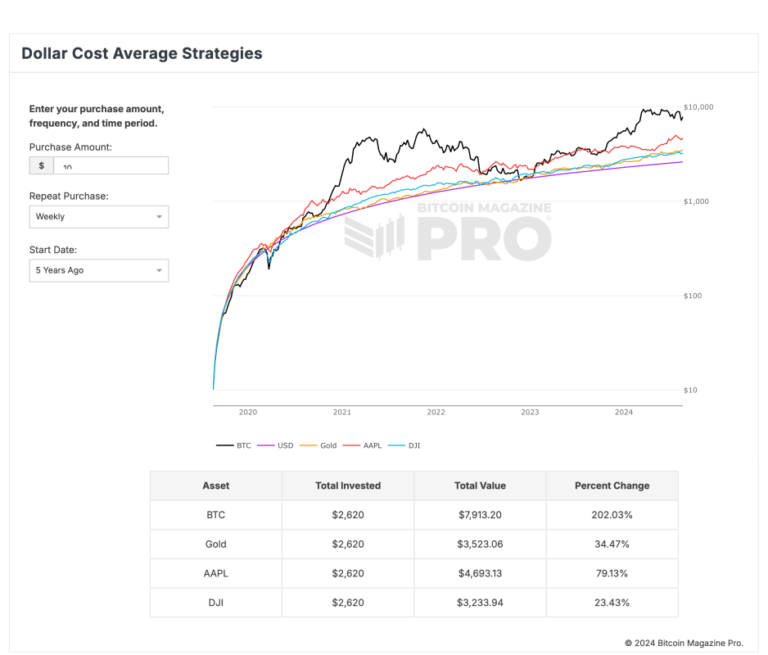

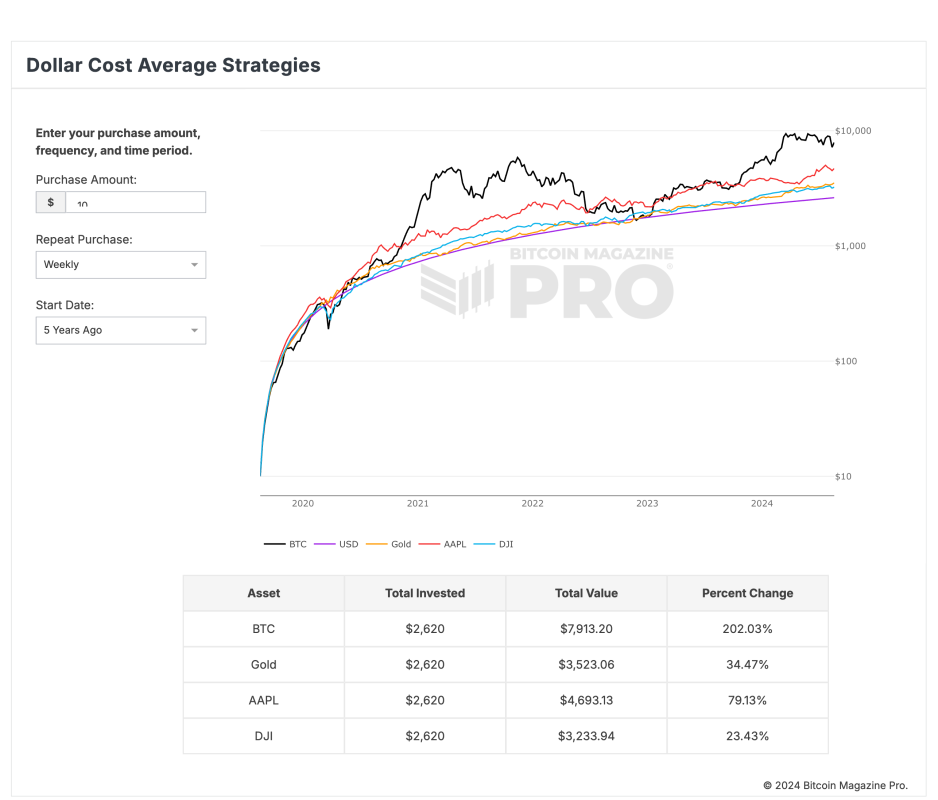

A current evaluation by Bitcoin Journal Professional showcases the ability of Bitcoin’s dollar-cost averaging (DCA) in comparison with conventional property like gold, Apple inventory, and the Dow Jones Industrial Common (DJI). Knowledge reveals that over the previous 5 years, a constant funding of $10 in Bitcoin each week would have elevated the full funding from $2,620 to $7,913.20, a return of 202.03%.

By comparability, the identical $10 weekly funding in gold would have returned 34.47%, growing the preliminary $2,620 to $3,523.06. Apple inventory additionally carried out properly, returning 79.13%, turning a $2,620 funding into $4,693.13. In the meantime, the Dow Jones Index had the bottom return, rising 23.43%, with the funding quantity growing to $3,233.94.

This information highlights Bitcoin’s potential to grow to be certainly one of, if not the, finest asset for traders to incorporate of their long-term funding methods. The precept behind dollar-cost averaging — investing a hard and fast quantity at common intervals no matter worth fluctuations — has confirmed significantly efficient with Bitcoin, permitting traders to construct wealth over time.

Saving $10 every week in Bitcoin by way of greenback price averaging (DCA) offers an reasonably priced and easy-to-use means for newbies to start out investing in Bitcoin. This technique is especially engaging to those that could also be hesitant to take a position a big sum of money up entrance or who’re nonetheless studying concerning the volatility of the Bitcoin market. By making small mounted investments regularly, people can step by step improve their Bitcoin holdings, scale back the affect of market fluctuations, and make it simpler to undertake a long-term funding mindset. This method permits for continued progress over time with out the strain of making an attempt to completely time the market.

Bitcoin Journal Professional’s dollar-cost averaging technique device permits customers to discover numerous funding methods to optimize their Bitcoin investments over totally different time frames. The device compares Bitcoin’s efficiency to different property such because the U.S. greenback, gold, Apple inventory and the Dow Jones Index, illustrating Bitcoin’s potential as a superior retailer of worth in a well-rounded portfolio.

For extra particulars, insights, and to enroll in entry to Bitcoin Journal Professional’s information and evaluation, go to the official web site right here.