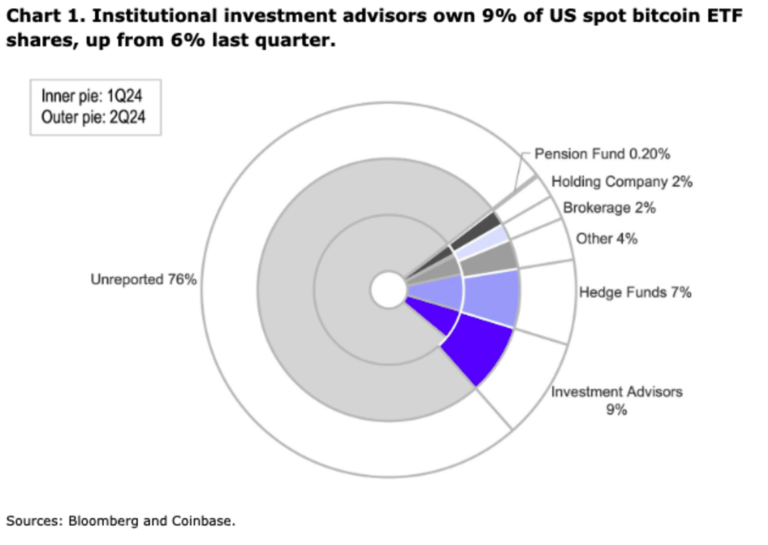

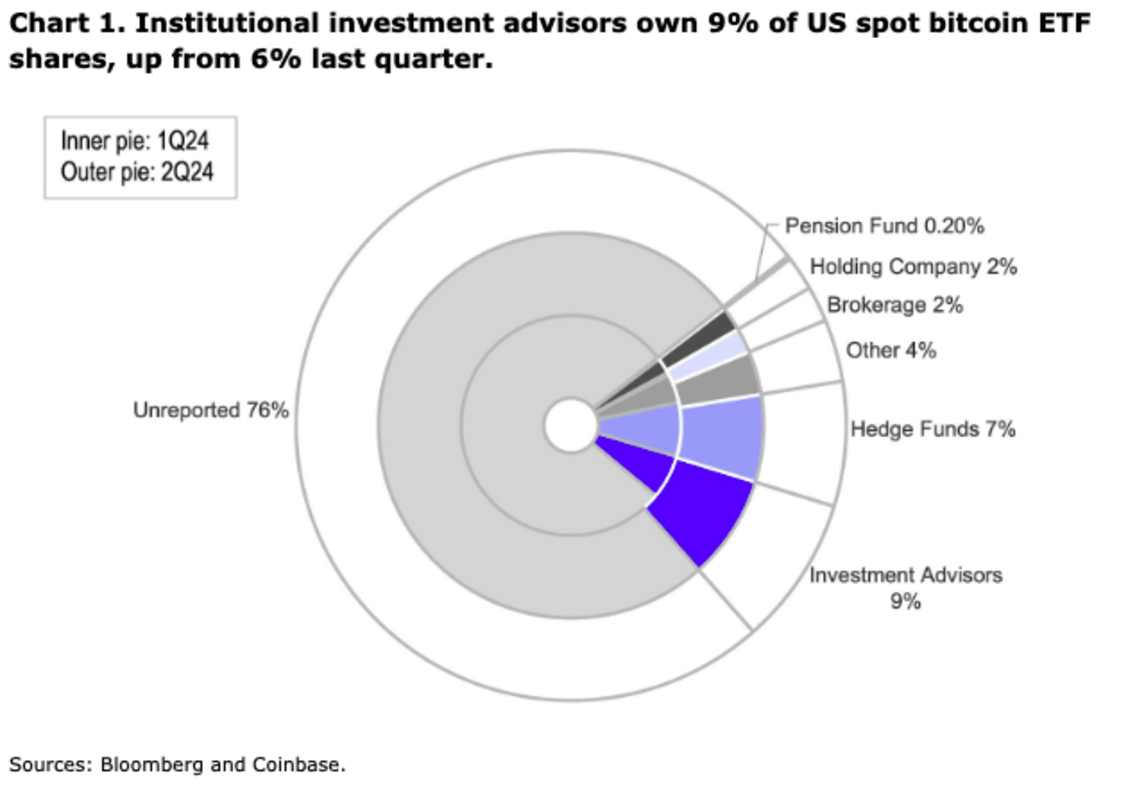

Coinbase reported that its up to date 13-F submitting for the second quarter of 2024 confirmed a big improve in institutional inflows into the U.S. Spot Bitcoin ETF, which the corporate believes is a “promising indicator” for the Bitcoin market. The 13-F submitting launched on August 14 confirmed that institutional possession of those ETFs grew from 21.4% to 24.0% between the primary and second quarters of 2024.

It’s value noting that the proportion of ETF shares held by the “Funding Advisor” class elevated from 29.8% to 36.6%, indicating the rising curiosity of wealth administration firms. Notable new shareholders embody Goldman Sachs and Morgan Stanley, which added $412 million and $188 million value of shares, respectively. Though Bitcoin costs fell in the course of the quarter, web inflows into spot Bitcoin ETFs reached $2.4 billion.

Coinbase reported that “regardless of whole spot Bitcoin ETF AUM falling from $59.3B to $51.8B (as BTC fell from $70,700 to $60,300), the ETF noticed web inflows of $2.4B in the course of the interval.” “We consider continued ETF inflows throughout a interval of Bitcoin underperformance could possibly be a promising indicator of continued curiosity within the cryptocurrency from the brand new pool of capital supplied by ETFs.”

Coinbase and Bloomberg

Coinbase expects this development to proceed as extra brokerage companies full due diligence on Bitcoin ETFs, notably these of registered funding advisers. Nonetheless, the report additionally famous that short-term capital inflows could also be affected by seasonal elements and present market volatility.

“We consider that as extra brokerage companies full due diligence on these funds, we might even see the proportion held by funding advisers proceed to extend,” the report mentioned. “Within the quick time period we could not instantly see numerous Funds are flowing in as it may be harder to draw prospects in the course of the summer time, when extra individuals are on trip, liquidity tends to be diminished and value actions will be unstable.”