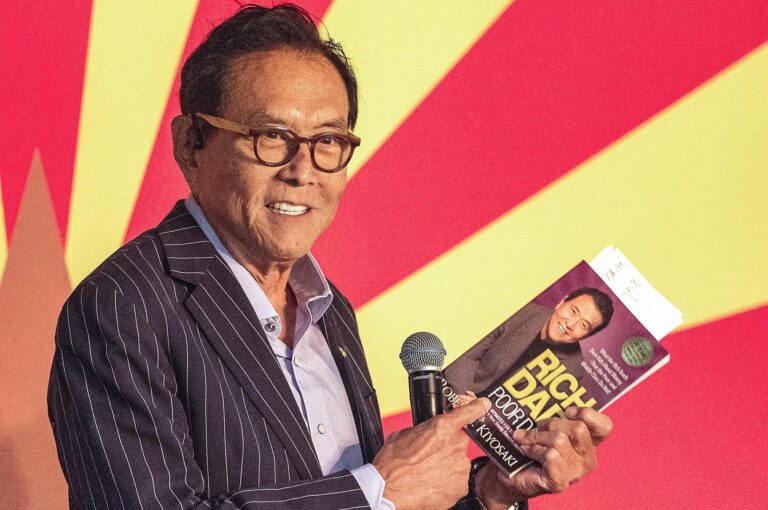

Robert Kiyosaki, creator of the private finance bestseller Wealthy Dad, Poor Dad, has issued one other monetary warning, this time focusing on the U.S. greenback and potential challengers — gold-backed stablecoins from the BRICS international locations (Brazil, Russia). India, China and South Africa).

Kiyosaki, a long-time advocate of “actual currencies” resembling gold, silver and Bitcoin, worries that BRICS currencies may set off hyperinflation in the US, inflicting the greenback to lose its international dominance and ultimately collapse.

Hyperinflation or exaggeration?

Whereas Kiyosaki paints a stark image of a flood of {dollars} flooding the U.S. financial system, consultants stay divided on the true influence of BRIC. The existence of stablecoins continues to be being mentioned inside the BRICS alliance.

If it does come to fruition, its most important objective is more likely to be to facilitate inner commerce between member states, doubtlessly decreasing their reliance on the U.S. greenback in worldwide transactions.

Presently in South Africa, a rustic I really like. Watch and take heed to rumors about what’s going to occur when the BRICS international locations (Brazil, Russia, India, China, South Africa) produce a BRICS cryptocurrency which may be backed by gold. If the BRICS gold cryptocurrency seems with trillions of counterfeit cash and fiat US {dollars}…

— Robert Kiyosaki (@theRealKiyosaki) May 12, 2024

This shift will undoubtedly weaken the greenback’s international hegemony, however monetary consultants are extra cautious than Kiyosaki when predicting hyperinflation. Regardless of the challenges, the U.S. financial system stays related. An entire collapse of the U.S. greenback appears unlikely within the close to future.

About Hyperinflation and Stablecoins

So, what precisely is the BRIC forex, and why is Kiyosaki so afraid of it? Stablecoins are cryptocurrencies which might be pegged to real-world property, resembling gold, to guard in opposition to the wild value swings that usually happen with conventional cryptocurrencies.

Bitcoin is at present buying and selling at $62.584. Chart: TradingView

In idea, a gold-backed BRIC forex would supply stability and doubtlessly problem the greenback’s dominance in worldwide commerce, particularly for commodities resembling oil, that are at present priced in {dollars}.

Kiyosaki: Prophet or provocateur?

Kiyosaki is not any stranger to daring monetary forecasts. Whereas his Wealthy Dad Poor Dad sequence has offered hundreds of thousands of copies, a few of his previous predictions have but to come back true.

His dire warnings concerning the greenback and hyperinflation needs to be taken with a grain of salt, particularly given his vested curiosity in selling various property like gold and Bitcoin.

Past the Hype: Constructing a Resilient Portfolio

If the BRICS stablecoin turns into a actuality, it’s unlikely to develop into an in a single day revolution. However it may mark a shift within the international monetary panorama. America, dealing with a possible erosion of the greenback’s dominance, could need to deal with strengthening its personal financial fundamentals.

Featured picture by way of Getty Photographs, chart by way of TradingView