in the most recent analyzeJames Coutts, chief crypto analyst at Realvision, said that Bitcoin may be bullish in the near term. He attributed the change in forecasts to changes in global liquidity indicators, especially the global money supply (M2) index, which is widely regarded as the most important. price catalyst. Coutts detailed this expectation in an article on X, where he examined the relationship between major economic indicators and Bitcoin price cycles.

Global money supply and its correlation with Bitcoin

Coutts’ analysis starts with M2 monetary aggregates, which include cash, check deposits and easily convertible quasi-currencies. He tracks these aggregates for the 12 largest economies, all adjusted in U.S. dollars. He believes this measure is critical to understanding liquidity within the global fiat credit financial system. “Money stocks often move in one direction, and large declines like the one in 2022 are rare and usually short-lived,” Coutts said.

Related Reading

Currently, global M2 is neutral, but Coutts predicts that this is about to change: “My macro and liquidity dashboards are all red, but there are signs that this is about to change. Since global M2 is highly correlated with the BTC bull cycle, It is therefore key to the next phase of this cycle.

The rate of change of M2 money supply is more important than its nominal value. Coutts noted, “This chart confirms what our MSI performance table indicates: Bitcoin generally moves with changes in M2 momentum.” He explained that although the global money supply MSI indicator is in an uptrend, momentum remains subdued , maintaining MSI neutral. To turn to a bullish MSI signal would require added momentum, requiring a combination of dollar depreciation, credit expansion and increased government debt issuance.

Coutts pointed to the key role of credit conditions, as evidenced by corporate bond spreads (BBB/Baa) compared to U.S. 10-year Treasury yields, which historically coincide with major inflection points in the Bitcoin cycle. “These spreads are currently narrowing, suggesting that despite higher interest rates due to record hikes in 2022 and 2023, companies are still finding ways to issue and roll over debt,” he said.

Related Reading

Using the Chameleon Trend indicator on the Corporate Spread Index, Coutts suggests a strategy: “Go long Bitcoin when the index shows a bearish trend (turning red) and remain alert for potential trend reversals (turning green).”

The role of the dollar and future prospects

Kutz believes that the key to this cycle is the performance of the DXY (U.S. Dollar Index), which measures the U.S. dollar against a basket of foreign currencies. “The U.S. dollar is range-bound. A break below 101 will be rocket fuel for Bitcoin.

Coots also talked about the debt situation in the United States, saying that if Congress does not adopt a conservative attitude change and advocate fiscal responsibility, more deficit spending may occur, which may further affect the liquidity situation in favor of Bitcoin.

Coutts concluded with a note of caution and optimism: “While my framework requires 2/3 of MSI indicators to turn macro headwinds into tailwinds, Bitcoin price action will likely smell a break in the macro before most indicators react. this change.

His analysis suggests that it would be unwise to short Bitcoin if it breaks out of its all-time highs, as the price is expected to climb to $150,000 this cycle. “DXY holds the key to the Bitcoin cycle as it instantly reflects the market’s expectations for liquidity. Liquidity is coming. Watch the 101/102 level on DXY, if this level is broken then we should see this cycle About $150,000 in Bitcoin,” he commented.

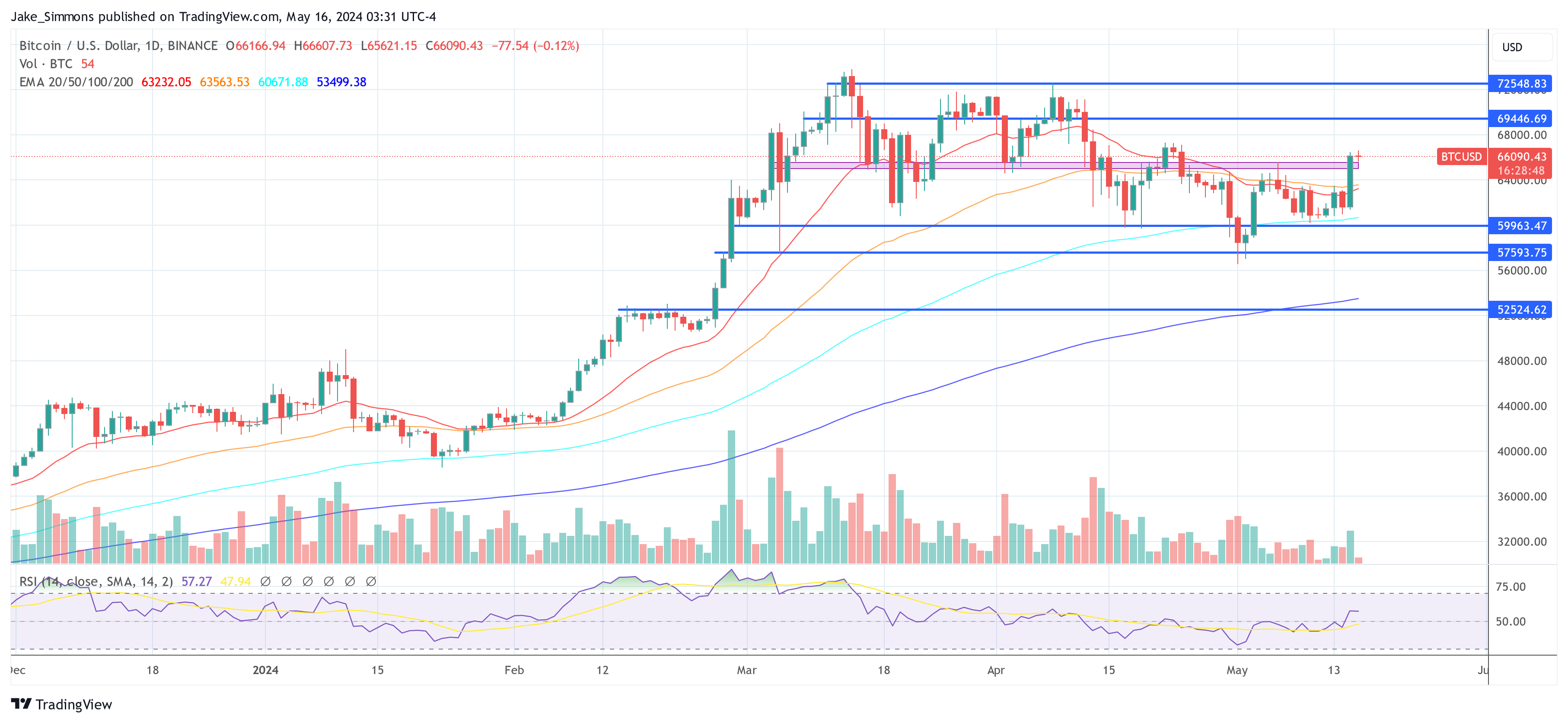

At press time, BTC was trading at $66,090.

Featured image created with DALL·E, chart from TradingView.com