The high-speed blockchain network Solana (SOL) is facing a balance. While experiencing short-term price gains, analysts have warned that prices could plummet if key technical levels collapse.

Related Reading

Flashes in bullish haze

The price of SOL has recently increased by 3.60% and is currently hovering around $162. However, this seemingly positive move comes within the context of a broader downward trend. Analysts attributed the shift to changes in market sentiment.

Meanwhile, the altcoin’s RSI is 48, indicating a neutral stance. Therefore, SOL has room to move in either direction as it is neither overbought nor oversold.

Trading activity has declined, which is typical during periods of consolidation. A surge in volume following a breakout should confirm the trade’s trajectory.

Lifeline or looming abyss?

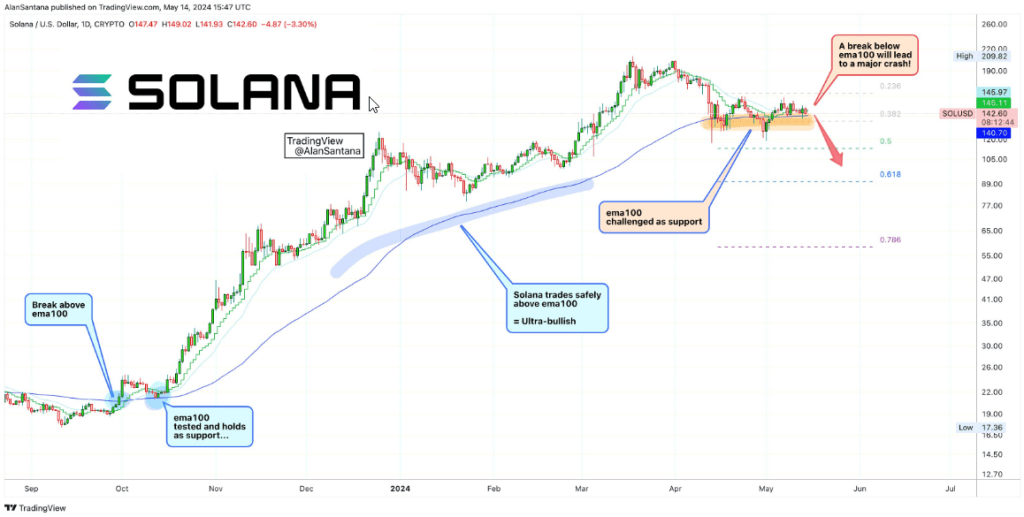

Cryptocurrency analyst Alan Santana highlighted the importance of the Exponential Moving Average 100 (EMA 100) as a key support level for SOL. EMA 100 is a technical indicator that reflects the average price over the past 100 days.

✴️Support weakens | Solana falls below 100#sol | #solana

Trend following systems use moving averages as the primary tool to generate trading signals for system traders; moving averages, along with RSI, are like the Holy Grail of technical analysis.

Moving… pic.twitter.com/9d5NrjuWWR

— Ellen Santana (@lamatrades1111) May 14, 2024

Historically, SOL has found support at this level during bullish periods. In September and October 2023, price crossing EMA 100 indicated positive market sentiment. However, a recent trend reversal has cast a pall over this once reliable indicator.

Potential price collapse

Santana warned that a break below the current EMA 100 (around $140) could trigger a sharp decline in SOL.

Such violations can instill fear among investors, potentially leading to sell-offs and depressing prices. Analysts warn that if this happens, the price could fall below $100.

Solana: Beyond Technology

While technical analysis paints a worrying picture, it is important to remember the volatility inherent in the cryptocurrency market.

Short-term forecasts based on technical indicators may not always be correct. Other factors, such as industry news, regulations and broader market trends, can also play an important role in price movements.

Related Reading

For example, a positive regulatory stance on cryptocurrencies could boost investor confidence and lead to higher prices, even if technical indicators point to a downward trend.

Conversely, negative news about a blockchain hack or security breach could trigger a sell-off, ignoring bullish technical signals.

the road ahead

Solana’s future trajectory remains uncertain. Will the $140 price point serve as a springboard for recovery, or will it collapse, sending SOL further down?

Featured images from Pngtree, charts from TradingView