Schulz

Utilities shares are the third-best performer among the many 11 S&P 500 sectors this yr. Superior 13.6%. Its accompanying Utilities Choose Sector SPDR Fund ETF (NYSE:XLU) do higher, up 14.2%.

The business has recovered all its losses Beginning in 2023, on the similar time Up almost 8% Solely in Might. The latest outperformance has been aided by rising recognition that the utilities business has turn out to be a synthetic intelligence (AI) business.

Many main U.S. utility corporations reported their newest quarterly ends in late April and final week, with some citing elevated demand for energy in knowledge facilities to help complicated synthetic intelligence processes comparable to language studying fashions.

A analysis report launched by Goldman Sachs earlier this week confirmed that synthetic intelligence is predicted to drive knowledge middle energy demand to develop by 160% by the top of this decade. Goldman Sachs predicts that U.S. utilities might want to make investments roughly $50B in new technology technology capability simply to help knowledge facilities.

“On common, processing a ChatGPT question requires almost 10 occasions as a lot energy as a Google search. The distinction is as a result of impending dramatic adjustments in how electrical energy is consumed within the U.S., Europe and the world at giant and the way a lot it prices,” Goldman Sachs mentioned.

“For years, knowledge middle energy demand has been remarkably secure, at the same time as workloads continued to extend. Now, because the tempo of enhancements in energy effectivity slows and the substitute intelligence revolution features momentum, Goldman Sachs Analysis estimates that knowledge middle energy demand will Development will attain 160% by 2030,” the brokerage added.

“For the primary time in many years, most likely in my 40 years on this business, we’re experiencing a scenario the place demand is pushed by demand slightly than commodity costs,” NRG Vitality CEO Larry Coben mentioned on the corporate’s Might earnings name. basic enhancements in driving.

“We, like each different forecaster I’ve examine, now count on a step change in long-term electrical energy demand. The rise in demand is because of a number of components… Current advances in GenAI are exacerbating and accelerating these components, resulting in The following energy demand supercycle is shaping up,” Coburn added.

Constellation Vitality (CEG) CEO Joseph Dominguez identified through the firm’s earnings name on Might 9 that “the demand for synthetic intelligence know-how and different digital infrastructure initiatives continues to develop.”

“We’re seeing curiosity in creating initiatives at a scale and scale that do not exist but, however there is a want for coaching techniques and different issues to construct and help all of those underlying fashions,” Dominguez mentioned.

Duke Vitality Corp. (DUK) chief monetary officer Brian Savoy mentioned on the corporate’s earnings name that knowledge middle development has been a “key driver” of power throughout areas within the industrial sector. He added that the business is seeing “unprecedented demand” from AI knowledge facilities and chip producers.

The utilities sector’s sizzling Might rally has buyers and market members involved, with some even saying it is performing like a meme inventory. Kevin Gordon, senior funding strategist at Charles Schwab (SCHW), famous on Thursday that almost 50% of the sector’s parts have hit new 52-week highs, the very best share since April 2022.

The rise in utility shares additionally comes at a time when rates of interest are at 23-year highs — an fascinating comparability. As regulated monopolies, utility corporations are usually seen as lower-risk investments, with wholesome money flows and secure dividends. Rising rates of interest hit utilities tougher than different sectors as a result of they will make bonds extra enticing to conservative buyers searching for yield.

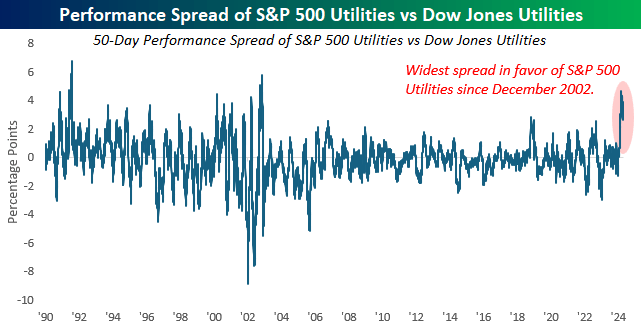

Bespoke Funding Group highlights the latest efficiency differential between the S&P 500 utilities sector and the Dow Jones Utilities Index (DJU) within the chart beneath, noting that the latest transfer represents the widest hole since late 2002: